- Joined

- 28 May 2020

- Posts

- 6,795

- Reactions

- 13,082

Cathy Wood offers an informative and interesting look at the coming year, from the 30:00 minute mark.

00:20:04 – Cathie’s Market Summary

00:24:04 – Fiscal Policy

00:24:07 – Total Public Debt Outstanding vs. GDP

00:26:03 –Total Public Debt Outstanding Divided by GDP

00:27:05 – Monetary Policy

00:27:08 – M2 Money Supply vs. CPI: Year-over-Year

00:28:01 – Yield Curve 10 Year Treasury Yield Minus 2 Year

00:29:10 – 10 Year Yield Minus 3 Month Yield: Consecutive Days Inverted

00:30:14 – Recession Probability – Federal Reserve Bank of New York

00:31:14 – Economic Indicators

00:31:19 – The Conference Board’s Leading Economic Index

00:31:39 – Total Continuing Jobless Claims

00:32:33 – Temporary Help Employment vs. Total Employment

00:34:01 – Piper Sandler Charts

00:38:33 – Market Signals

00:38:37 – US Dollar Index (DXY)

00:39:17 – Bloomberg Commodity Index

00:39:56 – Metals/Gold Ratio vs. US 10 Year Treasury

00:41:03 – Gold to Oil Ratio – Historical Chart

00:42:23 – Cathie’s Conclusion

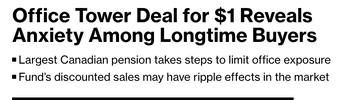

IMHO Cathy Wood is the female equivalent of Jim Cramer.

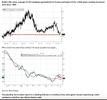

One look at the ARK chart is enough for me to treat he with a fair bit of skepticism.

Mick