- Joined

- 28 May 2020

- Posts

- 6,795

- Reactions

- 13,082

Yea, relates to test planes. The second part is if you can fly the plane the next day it was a great landing.i remember an old saying , any landing you can walk away from , is a good landing ... so is 'soft' one where you break a leg or ankle ??

and no mention of inflation in that:We are in a per capita recession apparently, if you include the new migrants in the calculation.

From the article:

Jury still out on how much more hip pocket pain coming our way

Australian households are paying the price for fixing an inflation problem they didn’t cause.www.smh.com.au

Real gross domestic product – the value of the nation’s production of goods and services – grew by only 0.4 per cent – the same as it grew in the previous, March quarter. Looking back, this means annual growth slowed from 2.4 per cent to 2.1 per cent.

If you know that annual growth usually averages about 2.5 per cent, that doesn’t sound too bad. But if you take a more up-to-date view, the economy’s been growing at an annualised (made annual) rate of about 1.6 per cent for the past six months. That’s just limping along.

And it’s not as good as it looks. More than all the 0.4 per cent growth in GDP during the June quarter was explained by the 0.7 per cent growth in the population as immigration recovers.

So when you allow for population growth, you find that GDP per person actually fell by 0.3 per cent. The same was true in the previous quarter – hence all the people saying we’re suffering a “per capita recession”.

As my colleague Shane Wright so aptly puts it, the economic pie is still growing but, with more people to share it, the slices are thinner.

It’s possible that continuing population growth will stop GDP from actually contracting, helping conceal from the headline writers how tough so many households are faring.

But the media’s notion that we’re not in recession unless GDP falls for two quarters in a row has always been silly. What makes recessions such terrible things is not what happens to GDP, but what happens to workers’ jobs.

The gummint disagreesand no mention of inflation in that:

if your GDP increases by 2.1% (in nominal figures) but with an inflation of 7% :

do we all agree we go backward???

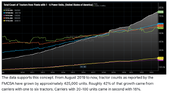

from my contacts in that industry ( management level now , local trucking has a severe shortage of capable workersSometimes one needs to spend some time on the correlation does not implycausation, but the correlation is still interesting.

Mick

View attachment 164070

The above graph is based on US statistics.from my contacts in that industry ( management level now , local trucking has a severe shortage of capable workers

now that could be because they expect truckers to be purer than saints ( or those with a licence to carry a concealable firearm

i would have expected drivers to be retrenched due to costs and a decline in freight , but am assured drivers are actually being 'head-hunted' by rival companies

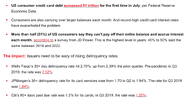

2. From CNN Business Consumers are spending more on groceries, but they are buying less.A confidence gauge that looks ahead six months dipped to 75.6 from 76.4.

For the past two months, the future-expectations index has been below the 80 mark that often signals a recession ahead.

Big picture: Americans have become more worried about the economy due to rising interest rates, higher gas prices and a faltering stock market.

3. from CNBC More and more American consumers are living from paycheck to paycheck (and I suspect the story is similar in OZ)Food manufacturers like Kellogg (K), PepsiCo (PEP) and Nestlé all reported sales growth in the first quarter of the year.

But even though sales are up, people are buying less. Growth has been fueled by higher prices, which offset declining volumes.

“If you look at the top-line dollar sales, it is obviously very positive,” said Alastair Steel, executive, client engagement for market research firm Circana, where he works on strategy and consults for clients. “But it really is driven by price increases.”

This year through May 21, compared to the same period in 2022, sales of fresh eggs by volume fell 4.7%, milk dropped 3.9%, packaged bread fell 3.8%, and fresh root vegetables slid 3.5%, according to Circana, which tracks US retail sales. in that time, dollar sales of eggs rose by 41.2%, milk rose by 0.9%, bread jumped 8.5% and fresh root vegetables rose 10.7%.

Prices of each of these items rose during that period. Fresh eggs shot up 48.2%, milk rose 5%, bread rose 12.7% and fresh root vegetables went up 14.7.

4. From Zero hedge Target has joined walmart in warning that consumers have cut back on spendingHigh inflation and higher interest rates continue to weigh on American households.

As of September, 62% of adults said they are living paycheck to paycheck, according to a new LendingClub report. The figure is unchanged from last year.

“Living paycheck to paycheck remains the main financial lifestyle among U.S. consumers,” the report said.

5. The same Zero hedge report highlighted how consumer credit card spending had tanked.Following the warning from ex-Walmart CEO Bill Simon regarding the American consumer nearing a 'breaking point,' Target's CEO, Brian Cornell, has also signaled a cutback in consumer spending, groceries included. This trend aligns with our view, as well as views from JPMorgan and Goldman, that consumers have hit a wall.

On Thursday morning, Cornell spoke with CNBC's Becky Quick on 'Squawk Box' about the retailer's challenges, including the cash crunch facing consumers amid high inflation. He provides a unique insight into consumer behavior patterns at stores nationwide:

"They're managing that budget really carefully, and it certainly is pressuring discretionary spending," Cornell said.

The exec continued: "They're purchasing fewer items, even within the food and beverage sector. When we examine overall retail spending and observe the top line, it appears there's a really healthy consumer out there spending money. But, even in the food and beverage categories, over the last few quarters, we've seen a decline in the units, the number of items they're buying."

"So, they're even tightening up their spending in those categories. In discretionary goods, we have seen seven consecutive quarters of decline in both dollars and units. This means consumers are buying less apparel, fewer items for their home, and fewer toys," he said.

MickJakarta | Manufacturing activity in Asia slumped again in October as conflict in the Middle East drove oil prices higher, costs rose and global demand remained under pressure.

Most countries across the region reported pressures from cost inflation, shrinking output and new orders, according to manufacturing purchasing managers’ indexes published on Wednesday by S&P Global and au Jibun Bank. A private gauge of factory activity in China unexpectedly contracted, underlining fragility within the world’s second-largest economy.

The data are a discouraging sign for the global economy, which has had its bid for recovery threatened by uncertainty over the Israel-Hamas war and the prospect of wider conflict in the region.

Asia – which makes much of the world’s goods – has struggled to step up production this year amid patchy demand from big markets including the US and Europe.

PMI readings for Japan and South Korea remained mired in contraction at 48.7 and 49.8, respectively, little changed from the prior month. A reading above 50 indicates an expansion in activity, while anything below suggests a contraction.

“The rate of inflation was robust and the strongest seen in the year to date amid reports of higher raw material prices, notably those linked to oil,” said Usamah Bhatti, economist at S&P Global Market Intelligence, in a statement accompanying the South Korean data.

Mr Bhatti also noted that firms had mentioned unfavourable exchange rates as their currencies came under pressure, leading to higher input costs.

Most of South-East Asia – which has typically been able to rely on the strength of its domestic markets to power growth – was in contraction in October. PMIs for Vietnam, Myanmar and Thailand deteriorated, while Malaysia was unchanged. Only Indonesia managed to expand in October from the prior month, though the rate of growth was slower.

The stop-start recovery is also evident in China, where the private Caixin survey of manufacturing activity fell to 49.5 last month from 50.6 the month before. That mirrored an official gauge this week that also showed factory activity shrank last month given the stretch of public holidays in the month along with muted market demand.

“Manufacturers were not in high spirits in October,” said Wang Zhe, senior economist at Caixin Insight Group, in a statement accompanying the Caixin data that cited falling supply, employment and external demand. “The economy has showed signs of bottoming out, but the foundation of recovery is not solid.”

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.