- Joined

- 20 July 2021

- Posts

- 12,099

- Reactions

- 16,838

depends on if you are calculating unemployment or under-employment ( not enough work to pay the bills with the primary income )The landing is looking pretty soft.

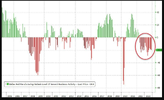

Unemployment though rising isn't that bad.View attachment 166195

am expecting a trend towards more robotics and automated systems to be introduced to combat wage demands and skilled worker shortage ( and we could always weed out the various 'public services ' , a lot of seat-fillers there )