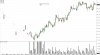

Anyone able to assist in providing ideas as to why this chart appears to have broken to the upside? Any clues in the consolidation area which would have provided us with a set up?

View attachment 58499

Looks like you have had a TL break 2 legs down, a double bottom and then a weak resumption of the trend with some sort of retest of the high.

Vanilla price action.

What happens next – who knows, you need more bars.