- Joined

- 8 June 2008

- Posts

- 13,130

- Reactions

- 19,317

I had a look rerunning the 2007-now, the 1/1/2019 to now and a few more specific period:Just a bit of friendly challenge. I don't know your system Mr frog, but over 1000 trades is the system broken or just the recent chop we are experiencing?

If it is the wrong market type, maybe the solution is a system filter or retaining it in your basket of systems but not necessarily that the system is broken.

Not saying either of you are wrong, but a different perspective.

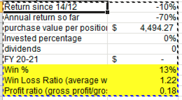

the results were 1/3 of my other trend systems so not up to scratch

and the curve were similar so not outperforming in lean time for my other systems so no need...

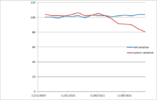

backtest 2007 to now vs dlqfduc:

and in graph:

just worse...in all factors.

I forgot the big picture so once initial backtest, I enhanced, improved that BO code but only comparing it to itself, without stepping back and considering the first question: is it worthwhile for either $ or diversification..and the answer is a clear cut NO

?

?