- Joined

- 20 July 2021

- Posts

- 11,280

- Reactions

- 15,654

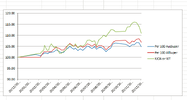

the gold dip should have been half-expected , Trump being elected will mean less life-lines to ungrateful corporations ( like Boeing )well as much as i was pleasantly surprised by trump win, this did not help my positions: heavy gold and silver and minerals:

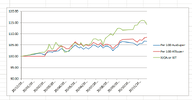

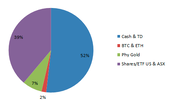

down 0.6% on the week back to September level whereas the asx is enjoying the SP rises of FMG, RIO and BHP so excited by the prospect of China tariffs (note WTF)

Overall an ASX index would have been much better: XJT rising with a 13% gain in the last 11 months while my setup is up a miserly 7%.

Good figure but not in perspective of a pure index etf

View attachment 187626

sadly the dip was not quite deep enough to tempt extra buying ( by myself )