- Joined

- 5 June 2007

- Posts

- 1,045

- Reactions

- 1

Nomore,

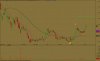

Why don’t you base profit objectives not only at a price target but also

a Time ‘Target’

I know Nick doesn’t give a rats about Time, but if you are trading a

Weekly timeframe ie closes on Friday, then often a trend can last into Friday.

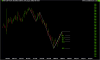

That means Price stalls at resistance or reaches your target:- Point A

and Partial cover. Then you would trade-manage the 2nd parcel based on

the closure on Friday:- Fail or Break

If Friday breaks and closes above resistance, this would normally

lead into a 2nd wave upwards and continuation higher, as resistance

has failed and has been verified by a higher timeframe close:- Breakout

Sure partial exit at a first target, but define the 2nd stage of the trend

by Friday’s close. If Friday closes above resistance there is less reason

to cover, simply run trailing stops.

Let the market tell you whether the entire trade should be exited

simply using the Price action that's occurring, and combining a price

target and then trade management using a time variable and closing price.

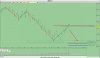

On most occassions price will stall and reverse and once again move

into another consolidating trading pattern. But occassionally you'll get

a stock, currency or any derivative that just continues.

And if the latter occurs you introduce your larger Secondary and Primary wave counts.

Just a thought.

..... nice work, Frank ... !~!

have a great weekend

paul

=====