- Joined

- 4 November 2007

- Posts

- 292

- Reactions

- 0

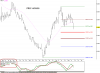

Thanks for reminding me Boggo!! Shame I was running a tight stop on this one and got stopped out only to then watch it hit the target I had set.  What was it that Ned Kelly said before he was hung........

What was it that Ned Kelly said before he was hung........