- Joined

- 10 July 2004

- Posts

- 2,913

- Reactions

- 3

Re: OIL AGAIN!

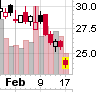

DOWN -$3.95 (-8.64%) to $41.78 bbl as I type.

We can see a bounce in crude oil till $62 bbl in a week or two. Crude Oil is once again going to move towards its high.

DOWN -$3.95 (-8.64%) to $41.78 bbl as I type.