- Joined

- 13 February 2006

- Posts

- 4,979

- Reactions

- 11,150

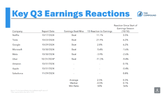

Big Tech. earnings are not being welcomed. They are carrying the whole market lower.

Mr FFF's last post:

POOF! Goodbye iBankCoin

Thu Oct 31, 2024 9:31am EST 34

Seventeen years ago a much younger Fly took to the internets with the intent to change the way people talked about finance. At the time, there was a wide chasm between boardroom jargon and the so called professionals, whether it was online or on CNBC. In the beginning, I was known for saying outlandish things, writing funny articles about my experiences in the market; but it wasn’t too far into the beginning of the site when the financial crisis hit and my bonafides were firmly established, having nailed that and many others since then.

The halcyon days of the blogosphere pre Twitter was something to behold and I did my part in creating a community of like minded lunatics. We traded and did it well and argued and got mad at one another; because that’s what men do when competing.

Once upon a time, the site hosted 200 bloggers, did a few public events, and regularly trolled CNBC with malicious intent. But those days are long over and I made a promise to you long ago that I’d never blog past the age of 47.5. Lo and behold, here I am at 48 with news that I am retiring from blogging as “The Fly”, in exchange for getting back into the field of professional money management.

You have to understand, I have been given a gift from God to see what others cannot and my skillset is wasted by simply talking to a gaggle of ne’erdowells. Whilst I do appreciate your evergreen support and company, The Fly was always destined for greatness and I must bid you adieu.

Many thanks to all of you who’ve read me since 2007 and before that on other sites. I have enjoyed blogging here and feel grateful for the opportunity to share my thoughts and concerns with you over so many blogs: 25,000+ but who’s counting?

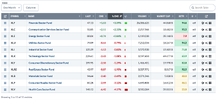

Plans for the future entail running my own shop, not a hedge fund but investment advisory, and I intend to do so with the utmost skill and professionalism that you’ve come to expect over the years: winship. I will continue to write, but under client portal. Thanks to the financial tools I’ve created with Stocklabs, my skills have never been better and I do intend to continue to invest in its technology.

For financial advisory inquiries, email me at Flybroker@gmail.com.

For this important day, killing iBC on Halloween of 2024, I put together some merch for you to peruse and possible purchase, in memory of the site.

If you’ve enjoyed my writing over the years and never knew about or purchased my books, they are available on Amazon.

And now for a video goodbye from Le Fly, aka Senior Tropicana, aka HORATIO CLAWHAMMER.

Ciao and Fin.

For those that want to watch the video:

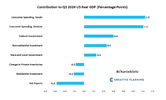

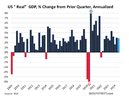

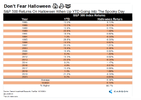

Economy:

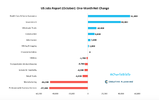

Consumer spending up, will that continue if UE jumps higher?

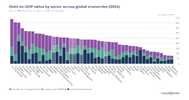

Government spending up, courtesy of increased debt.

Trade deficits massive.

Debt/GDP still increasing. The power of compounding debt outruns all combined spending.

A healthy economy? LOL.

“Watch your thoughts; they become words. Watch your words; they become actions. Watch your actions; they become habits. Watch your habits; they become character. Watch your character; it becomes your destiny.”

- Lao Tzu

Of course it's froth. When in a bull market there is demand, Wall St. will create endless supply.

Didn't last long, but: "We are in a different market now — and this market now is not being driven by futures, it's being driven by metal," he explained. "As the (gold) price has gone up, it's been driven by ... buying of metal, which means that the fundamentals keep moving up."

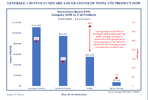

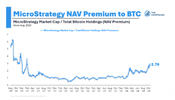

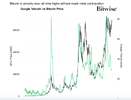

Eric Balchunas tweeted about MSTU, which is an ETF that gives you twice the daily exposure of Microstrategy, which itself is a levered bet on Bitcoin. Bitcoin is up 65% year-to-date. MSTR is 307%. But why stop there? Why not have two times the daily exposure of the two times exposure? |

This ETF, which launched just six weeks ago, is already in the top 1% of volume, right there with GLD. |

Eric said, “It’s so funny they’ve long had 3x MSTR ETFs in Europe but no one cares, no assets, volume.” |

We spoke with Jason Zweig on TCAF last week about the gamblification of the markets that is apparently unique to Americans. |

As much as I enjoy gambling, I don’t love it in the market. But as I told Jason, it’s not 100% bad. |

If people can keep it to a small amount, that’s good. If people can learn that it’s a fruitless exercise, that’s good. If it teaches them that the market is a serious place and is, in fact, not a casino, that’s good. And if they can learn this lesson at an early stage before they accumulate real money, that’s great! |

|

Against the odds, but sucking wind today.

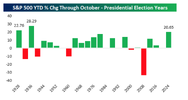

This market is an interesting mix of historical markets. The UST market harks back to the late 1940's/50's market with the enormous Debt/GDP level. The economy however post WWII was growing at an enormous clip. Today the war is not ending but escalating and the US is losing it on the hot side. Add in a new Cold War, which is also being lost, unlike Cold War I which was won and debt is unequivocally going to continue to rise.

The stock market has the euphoria and overvaluations of the late 1920's and 1990's. In the 1920's Investment Trusts were the ETF's of the day and were springing up willy-nilly. The 1990's had the earnings free dot.coms. Today we have leveraged ETF's on anything and everything, you just know that this will not end well.

The warning signs are everywhere.

Standing against the wind is the Fed. LOL.

Against that backdrop, Mr FFF has moved into (back into) professional money management. I'm trying to remember how he fared through the 2008 period. I'll probably have to refer to my notes made at the time.

Nonetheless it's a shame that his blog will no longer be a feature, always amusing, often insightful.

jog on

duc