- Joined

- 16 March 2020

- Posts

- 132

- Reactions

- 19

Please note this is from yesterday.

DAY 29 – Apex Sniper Trading Bootcamp – Daily Sim Review …

Today is the third day of Sim Trading …

Actions I took:

The Third day of Sim Trading – Losing Day

I had a busy day so could not focus on my trading. (Lesson 1)

Lesson 1 – I missed several trades because I was not focussed – I need to remember to walk away and come back when I can focus.

The market had some big moves and was very fast most of the US Day. (Lesson 2)

Lesson 2 – The markets were so quick that I didn’t have time to ensure they were valid. There will always be another trade so I don’t have to take the potential trade in front of me.

What I did right, was not to take revenge trades or trades that I was not sure were valid or didn’t have time to validate.

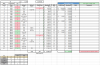

Today, I live sim traded 2 trades, 1 ES (Loss), and 1 NQ (Win). Total Loss – $190.

The running P/L for 3 days trading 1 contract on Sim Live is $122.50

Trade 1 Review – ES Short OD Divergence

Let me first explain how to tell OD Divergence.

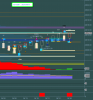

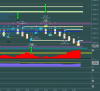

If you look at the chart below you will see the bar on the left has a black number above it (13K). On the fourth bar from the right, you will see a white number above it (18K). As per the normal rules of divergence it requires for a short to have made a Higher High and the indicator makes a LL.

I find that the OD divergence is very accurate. It would require for this example, that the second OD number be at least 80% of the first but preferably 50%.

At the time I took the trade (Arrow marked OD Short), The bar had an OD number of approx 60% of the 13K. I took the trade, was stopped out and when the price went higher, the OD moved to the HH. I know that the OD number is dynamic but I have never been caught out by this before. At the time I entered it was a valid trade.

The trade became a valid trade where the second arrow (marked Missed Valid). I missed this trade as I was still reviewing the loss (Lesson 3). This trade was two types. First a DR Divergence trade and secondly an Enhanced trade.

Lesson 3 – Be in the NOW and focus on the chart

DR Divergence

Below the chart, you can see the red and green histogram. This is the trend direction indicator. Note below the first OD Short arrow compared to below the Missed Valid Arrow, this indicator has two hills. Price made Higher Highs and the DR Indicator made Lower Lows … therefore DR Divergence.

Enhanced Trade

There are a couple of different forms of enhanced trades but this one is identified by:

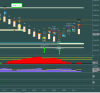

Trade 2 Review – NQ Short OD + DR Divergence

This was a simple trade and the reasons I took it is explained above.

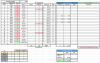

The following is the trades from the NT7 Summary Panel

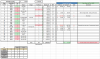

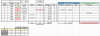

Potential trades for Tuesday for ES and NQ

Today, especially during the US daytime was very fast on both markets. NQ was quicker then ES.

In my list of potential trades for the day, I have not listed a number of trades as I would consider them not to be realistic trades.

Apex Investing does have a Semi-Automated program that would have helped to get into quick trades. I believe that this program is for more experienced traders who already know the rules and can make super quick decisions on the validity of the trade. I have heard only good things about the program but have not yet used it.

I will report back tomorrow on my progress and any lessons I learn

Disclaimer

I am not affiliated with any of these companies.

DAY 29 – Apex Sniper Trading Bootcamp – Daily Sim Review …

Today is the third day of Sim Trading …

Actions I took:

- Listened to the trading room for the first 180 mins of the US Open

- The third day of Sim Trading

- Reviewed the potential trades for Wednesday for ES and NQ

The Third day of Sim Trading – Losing Day

I had a busy day so could not focus on my trading. (Lesson 1)

Lesson 1 – I missed several trades because I was not focussed – I need to remember to walk away and come back when I can focus.

The market had some big moves and was very fast most of the US Day. (Lesson 2)

Lesson 2 – The markets were so quick that I didn’t have time to ensure they were valid. There will always be another trade so I don’t have to take the potential trade in front of me.

What I did right, was not to take revenge trades or trades that I was not sure were valid or didn’t have time to validate.

Today, I live sim traded 2 trades, 1 ES (Loss), and 1 NQ (Win). Total Loss – $190.

The running P/L for 3 days trading 1 contract on Sim Live is $122.50

Trade 1 Review – ES Short OD Divergence

Let me first explain how to tell OD Divergence.

If you look at the chart below you will see the bar on the left has a black number above it (13K). On the fourth bar from the right, you will see a white number above it (18K). As per the normal rules of divergence it requires for a short to have made a Higher High and the indicator makes a LL.

I find that the OD divergence is very accurate. It would require for this example, that the second OD number be at least 80% of the first but preferably 50%.

At the time I took the trade (Arrow marked OD Short), The bar had an OD number of approx 60% of the 13K. I took the trade, was stopped out and when the price went higher, the OD moved to the HH. I know that the OD number is dynamic but I have never been caught out by this before. At the time I entered it was a valid trade.

The trade became a valid trade where the second arrow (marked Missed Valid). I missed this trade as I was still reviewing the loss (Lesson 3). This trade was two types. First a DR Divergence trade and secondly an Enhanced trade.

Lesson 3 – Be in the NOW and focus on the chart

DR Divergence

Below the chart, you can see the red and green histogram. This is the trend direction indicator. Note below the first OD Short arrow compared to below the Missed Valid Arrow, this indicator has two hills. Price made Higher Highs and the DR Indicator made Lower Lows … therefore DR Divergence.

Enhanced Trade

There are a couple of different forms of enhanced trades but this one is identified by:

- Reversal Bar

- Red Box at top of the bar

- New White Line (MM) from the bar

- An existing line (orange PP)

Trade 2 Review – NQ Short OD + DR Divergence

This was a simple trade and the reasons I took it is explained above.

The following is the trades from the NT7 Summary Panel

Potential trades for Tuesday for ES and NQ

Today, especially during the US daytime was very fast on both markets. NQ was quicker then ES.

In my list of potential trades for the day, I have not listed a number of trades as I would consider them not to be realistic trades.

Apex Investing does have a Semi-Automated program that would have helped to get into quick trades. I believe that this program is for more experienced traders who already know the rules and can make super quick decisions on the validity of the trade. I have heard only good things about the program but have not yet used it.

I will report back tomorrow on my progress and any lessons I learn

Disclaimer

I am not affiliated with any of these companies.