- Joined

- 16 March 2020

- Posts

- 132

- Reactions

- 19

DAY 17- Apex Sniper Trading Bootcamp – Daily Review …

Not the best day for ES!

Actions I took:

ES gave a lot of opportunities to lose money.

NQ is trading well during the US trading session. Some people are starting to trade more NQ then ES. I will continue with ES and from Monday, I will start recording the Potential Trades for NQ as well as ES.

Market Replay Lessons

Have your trading plan in front of you when you trade. This may sound common sense but I see a lot of people who are taking trades that are not valid trades. Just because it wins doesn’t mean it was a valid trade and can create bad habits.

After, listening in the live trade room it is easy to want to take other trades that I have not tested and fully trust.

This was a problem for me today when I started my Market Replay! I stopped and clarified the trade setups I was using and took ownership of that. After that, it was easier to focus on my trading and I stopped making silly mistakes if, in doubt, I referred to my setup notes for confirmation.

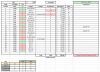

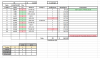

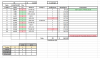

Thursday ES Potential Trades

This is one of the lowest ES profitable trade day lists that I have tracked.

The following is the legend for the trades sheet:

I will report back tomorrow on my progress and any lessons I learn

Disclaimer

I am not affiliated with any of these companies.

Not the best day for ES!

Actions I took:

- Good learning in the live trading room at US Open – Lori shared some great lessons

- Continued using Market Replay to improve my live market decision making for the live market

- Reviewed the potential trades for Thursday

ES gave a lot of opportunities to lose money.

NQ is trading well during the US trading session. Some people are starting to trade more NQ then ES. I will continue with ES and from Monday, I will start recording the Potential Trades for NQ as well as ES.

Market Replay Lessons

Have your trading plan in front of you when you trade. This may sound common sense but I see a lot of people who are taking trades that are not valid trades. Just because it wins doesn’t mean it was a valid trade and can create bad habits.

After, listening in the live trade room it is easy to want to take other trades that I have not tested and fully trust.

This was a problem for me today when I started my Market Replay! I stopped and clarified the trade setups I was using and took ownership of that. After that, it was easier to focus on my trading and I stopped making silly mistakes if, in doubt, I referred to my setup notes for confirmation.

Thursday ES Potential Trades

This is one of the lowest ES profitable trade day lists that I have tracked.

The following is the legend for the trades sheet:

I will report back tomorrow on my progress and any lessons I learn

Disclaimer

I am not affiliated with any of these companies.