- Joined

- 16 March 2020

- Posts

- 132

- Reactions

- 19

Ok, I was rushing to post everything within 5 mins of exit. That makes it easier for me just posting the entry even though I have to focus on the trade. I am in and out quickly.

It was my misunderstanding … I am happy to do it

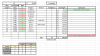

Apologies for my interruption, but I think you may need to rethink the 6:3 rule as posted.

I see your wins are +7 ticks and your losers are -17 (not -8 as posted).

Allowing six losers /day while stopping at 3 winners is not going to end profitably.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.