- Joined

- 16 March 2020

- Posts

- 132

- Reactions

- 19

Apex Sniper Trading Bootcamp – Challenge Countdown – 29 Days …

I struggled mentally today …

Actions I took today:

Today I struggled mentally!

I still have a headache from yesterday’s migraine. This stress intensified my underlying fears of missing out and losing. This was reflected predominantly in my emotions while I was trading.

I managed this extra stress by:

I have been looking at markets to see which is the best to trade at present.

When I say best, I mean:

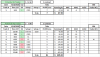

Todays Trades taken in Leeloo Account

ES – 3 trades – see description below – Total Loss -$187.50

YM – 1 winner, 1 loser = Net $0

ZB – 2 winning trades Total win $52.50

Total Loss running in Leeloo for 2 days = $-31.90

ES Trades

Trade 1 – 5:11 am

The entry was a valid Enhanced TX against the trend.

The bar before the entry was at 5:00.01, setup bar was 5:11:03, Entry bar was 5:35:22 and the next bar was at 5:53:31.

So you can see how slow the bars were closing. After entry, the price moved up and down that bar a number of times giving no feeling for direction and was sitting in between the two white (MM) lines.

My decision to move the stop to just above entry was based on the length of time in the trade, that price movement was ranging between the top and bottom of the bar and that price action was sandwiched between 2 lines (MM).

Trade 2 – 9:22

I entered a valid NXT Trend trade at the close of the 9:22 bar and as the bar had not hit the target and it was getting close to the market open, I closed the trade for a 1 tick profit.

Trade 3 – 10:02

This trade was a valid NTX trade with the trend that just failed!!

Looking at the chart, there was a possibility for the price to want to move down to the blue line (settlement). I will watch this type of occurrence to see the validity of my observation.

Resources:

Watch this space for more resources that I find useful.

I will include books, articles, podcasts, interviews, videos, hypnosis/meditation audios, mental exercises, and more …

I will report back tomorrow on my progress and any lessons I learn

Disclaimer

I am not affiliated with any of these companies.

I struggled mentally today …

Actions I took today:

- Traded my Leeloo Evaluation Account …

- Reviewed the market to identify trades I thought were valid trades on ES

Today I struggled mentally!

I still have a headache from yesterday’s migraine. This stress intensified my underlying fears of missing out and losing. This was reflected predominantly in my emotions while I was trading.

I managed this extra stress by:

- identifying what it was and that I why I was feeling this way

- reviewing the setup to ensure that it was valid as per my rules

- reviewing the active trade to see if the reasons for entry were still valid

- after the trade, reviewing the trade again to support that my process was valid

I have been looking at markets to see which is the best to trade at present.

When I say best, I mean:

- a tradable speed of the market

- liquidity in the market

- sufficient number of trades

- setups being respected

Todays Trades taken in Leeloo Account

ES – 3 trades – see description below – Total Loss -$187.50

YM – 1 winner, 1 loser = Net $0

ZB – 2 winning trades Total win $52.50

Total Loss running in Leeloo for 2 days = $-31.90

ES Trades

Trade 1 – 5:11 am

The entry was a valid Enhanced TX against the trend.

The bar before the entry was at 5:00.01, setup bar was 5:11:03, Entry bar was 5:35:22 and the next bar was at 5:53:31.

So you can see how slow the bars were closing. After entry, the price moved up and down that bar a number of times giving no feeling for direction and was sitting in between the two white (MM) lines.

My decision to move the stop to just above entry was based on the length of time in the trade, that price movement was ranging between the top and bottom of the bar and that price action was sandwiched between 2 lines (MM).

Trade 2 – 9:22

I entered a valid NXT Trend trade at the close of the 9:22 bar and as the bar had not hit the target and it was getting close to the market open, I closed the trade for a 1 tick profit.

Trade 3 – 10:02

This trade was a valid NTX trade with the trend that just failed!!

Looking at the chart, there was a possibility for the price to want to move down to the blue line (settlement). I will watch this type of occurrence to see the validity of my observation.

Resources:

Watch this space for more resources that I find useful.

I will include books, articles, podcasts, interviews, videos, hypnosis/meditation audios, mental exercises, and more …

************

I will report back tomorrow on my progress and any lessons I learn

Disclaimer

I am not affiliated with any of these companies.