- Joined

- 16 March 2020

- Posts

- 132

- Reactions

- 19

I don't know, that is why I was asking ...

I love questions but don't like jabs

I love questions but don't like jabs

Waiting to see, not interested in what other books you have read I have quite a few in my book case.It is time to test these trading companies and see who can deliver.

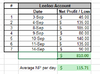

My journal will my progression:

My goal is to see if I can become profitable in 90 days.

- I will explain why I chose the courses on the short list and why I chose the first one to test.

- Right through to setup, back-testing, live trading and hopefully to profitability

- I will explain what works and what doesn't

- I will not be sharing anything that is proprietary to the company

If I fail, then I will start again with another 90-day challenge ... until I find a profitable course.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.