- Joined

- 3 June 2013

- Posts

- 457

- Reactions

- 53

Bought JIN, 1521 @ $1.08.

HI KTP, hope all is well.

Just a quick question and you may have covered this so forgive my laziness (of not wanting to go through the entire thread to get the answer)... Have you considered concentrating on fewer stocks rather than being spread so thinly across a larger number of stocks?

The reason I ask is, yes diversification is good and risk on each trade will be low in a total portfolio sense, but for me, diversification like this limits profit potential also.

Considering an averaging up strategy or "pyramiding" as some call it has enhanced my returns in trading/investing once I knew how to use it correctly.

E.g. I'll purchase a stock, lets call it XYZ... I purchase XYZ with at $1.00 and the entry risk (where I would place my stop) is at $0.80.... Therefore, the entry risk on this trade is 20%. Using this, I combine it with my total portfolio value, again for illustration purposes, it is $10,000 total. If one of my trading rules or money management rules is not to trade any position risking more than 2% of my total portfolio, I could position size this to purchase $1k worth of stock.

Let's say the price advances steadily and is now at $1.30 (giving us a profit of 30% on an open position). At this point, my stop loss has been adjusted and is trailing the price. Now my stop level may be $0.95 or even at break-even $1.00. With the right action on the stock, I may choose to purchase more of this same stock whilst still keeping my risk levels in check... Then rinse and repeat until the time comes to sell out (in which I sell all my holdings at once).

Any thoughts on whether this would be of benefit to you?

As I said, I have found it very useful.

An example is my trades in SEN recently:

CODE Purchase Date Purchase Price Disposal Price Profit/Loss %

SEN 29/07/2015 0 .2 0.18 -10.00%

SEN 20/07/2015 0.16 0.18 12.50%

SEN 4/05/2015 0.115 0.18 56.52%

SEN 16/02/2015 0.091 0.18 97.80%

Net result was a 34% average profit on the four trades and I made double the money I would have if I had just stopped at the first purchase.

Not criticising by any means but just adding my two cents and getting your brain thinking about this possibility.

It's a hell of a lot easier managing less positions too!

Hi Nortorious,

Position size is certainly a consideration in my strategy, and depends on the results I expect to achieve from it.

Keeping in mind that most of my trades are expected to be 3+ years, no stop losses and hit rate of <70%, I would be uncomfortable with a smaller position size then the 15-25 I am running now.

One of the strategies in my super has a historical hit rate of over 80%, I am confortable holding 10-15 stocks there.

With a more discretionary approach, I agree with you fully, I would have less then 10 stocks and I would average into them over time. For the current portfolio and forum thread, I prefer to stay closer to the systematic approach, I feel that higher concentration would be too risky here.

Thanks for the thoughts, it is very helpful to thing and write about these things.

Sold SSM, 6350 @ $0.365, for a profit of $1,076.75 (81%).

It was one of the few remaining shares from my old value portfolio. Recent price raise moved it from being very cheap to just cheap.

Nice result on your SSM trade KTP. A nice profit given what it looks like on the chart (a bit of noise above the current levels that may impede further progress...).

I'm pleased to see that you're buy more stocks that are going up.

Your performance will improve considerably and soon those benchmarks will be eating your dust.

Following an automated system certainly doesn't generate much discussion and I've been too busy lately with a new job to write myself.

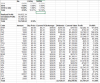

View attachment 66534

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.