- Joined

- 3 June 2013

- Posts

- 457

- Reactions

- 53

Hi Know

Really in-depth post and long running too.

Well done for your dedication to improvement and also for sharing your experiences and issues.

<snip>

However it is enjoyable as a hobby and the loss of a couple of % here or there and time is not a supremely expensive hobby.

Plus you have only a few years of data, in a long term 20-30 year horizon, that is quite small.

I hope I have not asked too much

cheers

Hi Omega and thanks for the feedback.

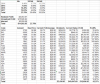

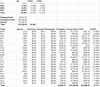

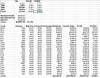

To properly evaluate my performance, there are two time period, that I think should be judged separately.

1. First 2 years, it was discretionary investing, holding mostly cash for a large period of time.

2. Last 2 years - semi-automated trading.

First 2 years, I have significantly under performed.

For the next 2 years, however, my automated portfolio (now ~80% of my stocks), have returned, as of 2 weeks ago, 49.78% vs XAO -1.5%. In terms of time taken to manage it, that has also drastically decreased in the last 2 years. Once, I do a quick scan with my software to see if anything needs to be sold/bought, usually not. Together with some record keeping, 1 hour/month is about right.

I run a different, but also automated strategy in my super, which has doubled in the last 4 years.

It has taken many, many hours to get to a point where I am comfortable doing this and get good results. The hourly rate, given the size of my portfolio is not good. But, you are quite right that it is an enjoyable hobby. As an aside, it led me to develop a back-testing tool, that I am now commercialising.

Also, 2 years is not much. 50% out-performance may not be sustainable. The goal is to keep learning and if I can keep up my rate of progress in knowledge and performance for another 5-10-20 years, I am sure the profits will more than make up for it.

To answer your specific questions:

Returns include bank interest, dividends and brokerage.

No tax or dividend imputation,

I do not calculate SD or volatility.

Cheers

KTP