- Joined

- 14 April 2007

- Posts

- 317

- Reactions

- 0

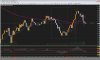

Trend is a trend right...

The stronger the trend the better right??

Why would you be worried about it falling quicker when you are riding the trend for as long as you can??

Having a predefined exit you will not be worried about whether it will fall or not

Depends....

If you were to follow the trend too closely you would capture the initial "steeper gradient" smaller trend but as it falls back you would get stopped out even though the trend may then continue upwards.

However, if the trend's gradient was less aggressive (but still constant and steadily rising) there would be a higher chance of capturing the larger trend resulting in better profits.

Of course this problem could be overcome by widening the trailing stop but that it another discussion.