- Joined

- 18 March 2009

- Posts

- 284

- Reactions

- 0

Other than Arbitrage,Id be really interested in even one other way to profit from the markets which doesnt involve a trend.

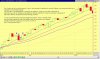

A move in price in either direction at any point of time is a trend in that direction.

We analyse and take trades IN ANTICIPATION of a move in our direction.

Not prediction---as those who have little knowledge of T/A presume.

i would have thought a trend requires past reference points. to have just one price(last traded price) u cant gain any trend information. to have 2points, the last traded and the price before that doesnt really provide a trend, it just telss us wether the price has gone up or down BUT doesnt create a trend.

trends definately occur over time and the longer the period used, the more accurate or reliable a trend is?

thats not to say you cant use the last 1hours prices to form a trend for that hour and then use that to ANTICIPATE future prices in coming hours.