... as you were saying Real1ty ... been bagging gold have I? ... & brought it down single-handed why don't you accuse me? because it IS DOWN, you must admit!

another interesting feature & which I have been pointing out quite some time back, if not on this forum then on the other one you were referring to:

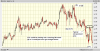

the Flight into Security which was supposed to be into Gold, wasn't into gold at all but into the Dollar & ten-year Bonds. the worthless fiat currency, would you believe. have a look at this:

<< "The same old reasoning still applies: The U.S. is regarded as being able to weather a recession much better than the euro zone," wrote strategists at Commerzbank.

Also, the European Central Bank has further to go in cutting interest rates than the Fed, which has already delivered the bulk of its interest-rate cuts in this cycle, they said.

Sadly this increase in the value of the $ will be counterproductive in the long run, damaging exporters ability to be competitive in a global market, and further damage US Exports. >>

"the same old reasoning ..." I like that! whoever I ask you ... in their wildest dreams ... ever expected that the Dollar would beat Gold in the able-to-weather-a-recession stakes?

the last paragraph, commencing with "Sadly..." unfortunately takes the wind out of the sails, any potential bulls still around ... regarding health of US economy.

you may notice that I am posting these comments on the LGL thread, I am doing that on purpose. on the assumption that not many people follow it. if I posted on the Gold thread, it could startle the horses. we don't want to cause any more damage if we can help it. anyway we've clarified one or two things, now let us watch events take their course.

for instance, the greenback vs. the Yen is not looking at all healthy, there could be some hidden meaning in that. the Golden turning-point perhaps?

hoping, not predicting. but with the blinkers off!

another interesting feature & which I have been pointing out quite some time back, if not on this forum then on the other one you were referring to:

the Flight into Security which was supposed to be into Gold, wasn't into gold at all but into the Dollar & ten-year Bonds. the worthless fiat currency, would you believe. have a look at this:

<< "The same old reasoning still applies: The U.S. is regarded as being able to weather a recession much better than the euro zone," wrote strategists at Commerzbank.

Also, the European Central Bank has further to go in cutting interest rates than the Fed, which has already delivered the bulk of its interest-rate cuts in this cycle, they said.

Sadly this increase in the value of the $ will be counterproductive in the long run, damaging exporters ability to be competitive in a global market, and further damage US Exports. >>

"the same old reasoning ..." I like that! whoever I ask you ... in their wildest dreams ... ever expected that the Dollar would beat Gold in the able-to-weather-a-recession stakes?

the last paragraph, commencing with "Sadly..." unfortunately takes the wind out of the sails, any potential bulls still around ... regarding health of US economy.

you may notice that I am posting these comments on the LGL thread, I am doing that on purpose. on the assumption that not many people follow it. if I posted on the Gold thread, it could startle the horses. we don't want to cause any more damage if we can help it. anyway we've clarified one or two things, now let us watch events take their course.

for instance, the greenback vs. the Yen is not looking at all healthy, there could be some hidden meaning in that. the Golden turning-point perhaps?

hoping, not predicting. but with the blinkers off!