- Joined

- 20 July 2021

- Posts

- 11,280

- Reactions

- 15,654

firstly

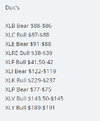

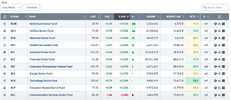

i use passive index funds as 'insurance ' ( both straight index funds and sector focused ones )

now Buffet once said , diversification is for people who don't know what they are doing , and i agree in 2011 and 2012 i was a novice so took the diversification option while i learned and gained experience and started 'cherry-picking' as i learned

( i still have the profits made on VAS running )

next, are index funds a bubble or do they just compound the bubble already inflating ( i suspect the later )

the index funds rely on market cap. for weighting , so i argue dumb ( or lazy ) money following the big money

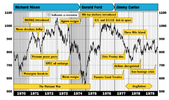

doom merchants ( i class myself as a contrarian bear )

i listened to several of these over the last 12 or so years

but did i flee the market ... NO ! , but sure i did bias more cash towards ( my idea of ) 'safe-havens '

sure i recovered the investment cash where sensible ( and redeployed it elsewhere )

if you have a ten-bagger paying dividends , why would you sell ( completely ) when earning 10% ( plus ) a year on div. returns , and hope to crack the next ten-bagger

( a bird in the hand , theory ) i often like to let the profits run ( after locking out a capital loss )

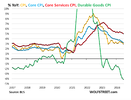

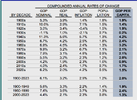

the CPI

that has been rigged for years/decades , the thing to understand is they haven't stopped rigging it , in fact they rig it more and more as years go by , so much of national economies ride on the phony CPI figures ( they just can't help themselves )

i use passive index funds as 'insurance ' ( both straight index funds and sector focused ones )

now Buffet once said , diversification is for people who don't know what they are doing , and i agree in 2011 and 2012 i was a novice so took the diversification option while i learned and gained experience and started 'cherry-picking' as i learned

( i still have the profits made on VAS running )

next, are index funds a bubble or do they just compound the bubble already inflating ( i suspect the later )

the index funds rely on market cap. for weighting , so i argue dumb ( or lazy ) money following the big money

doom merchants ( i class myself as a contrarian bear )

i listened to several of these over the last 12 or so years

but did i flee the market ... NO ! , but sure i did bias more cash towards ( my idea of ) 'safe-havens '

sure i recovered the investment cash where sensible ( and redeployed it elsewhere )

if you have a ten-bagger paying dividends , why would you sell ( completely ) when earning 10% ( plus ) a year on div. returns , and hope to crack the next ten-bagger

( a bird in the hand , theory ) i often like to let the profits run ( after locking out a capital loss )

the CPI

that has been rigged for years/decades , the thing to understand is they haven't stopped rigging it , in fact they rig it more and more as years go by , so much of national economies ride on the phony CPI figures ( they just can't help themselves )