- Joined

- 13 February 2006

- Posts

- 5,487

- Reactions

- 12,987

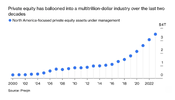

LBO's now called 'Private Equity'

Really not doing so well.

Mr FFF

Back in 1994 I started my first investment in internet companies. At the time it was nascent, almost conceptional, and people thought the smaller start ups didn’t stand a chance against $MSFT and some of the larger companies.

When I became a stockbroker it was all I fixated on and early on in my career, I was wrong. The internet stocks were going down, but I wasn’t dissuaded because I felt convinced, eventually, I’d be proven right.

When the dot coms turned around and went up, you could not stop them. We enjoyed daily 10-20% gains in the next fiber play or the next company to announce a website from which they’d sell their trinkets. But, at least in the beginning, the big money was made in the companies charged with building out the infrastructure for the internet.

Fast forward to today and generative AI is all the rage. We are in the infrastructure buildout phase involving fiber and active copper and servers and switches for the datacenters needed to power the AI applications that everyone is building.

I suppose there is a chief difference between then and now, which is back then most of the dot coms were cash burning start ups, whereas the AI field is being taken up by more mature start ups and essentially every Fortune 500 company in existence.

But the similarities are striking and it makes you wonder if the industry learned from their prior experiences in overbuilding?

Back at the beginning of the internet, there were haters too, people who said it wad all a fad. The eventual winners were the major web 2.0 plays, like $META, $MSFT and $AMZN. I suspect this time will be similar, with AI 2.0 analytics and web apps working in lucrative SAAS models into market, collecting gigantic sums of money.

But we still need to build the infrastructure and from my vantage point we have a solid 3 years of growth ahead of us, akin to 1997-2000.

Meanwhile:

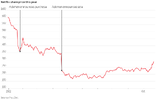

USD higher, UST Yields higher,

Bond market vol. higher.

Not a good combination.

Either we get additional liquidity pretty soon or stocks may well swoon.

jog on

duc

Really not doing so well.

Mr FFF

The Generative AI Rollout Rings a Bell

Mon Oct 28, 2024 10:22am EST 1Back in 1994 I started my first investment in internet companies. At the time it was nascent, almost conceptional, and people thought the smaller start ups didn’t stand a chance against $MSFT and some of the larger companies.

When I became a stockbroker it was all I fixated on and early on in my career, I was wrong. The internet stocks were going down, but I wasn’t dissuaded because I felt convinced, eventually, I’d be proven right.

When the dot coms turned around and went up, you could not stop them. We enjoyed daily 10-20% gains in the next fiber play or the next company to announce a website from which they’d sell their trinkets. But, at least in the beginning, the big money was made in the companies charged with building out the infrastructure for the internet.

Fast forward to today and generative AI is all the rage. We are in the infrastructure buildout phase involving fiber and active copper and servers and switches for the datacenters needed to power the AI applications that everyone is building.

I suppose there is a chief difference between then and now, which is back then most of the dot coms were cash burning start ups, whereas the AI field is being taken up by more mature start ups and essentially every Fortune 500 company in existence.

But the similarities are striking and it makes you wonder if the industry learned from their prior experiences in overbuilding?

Back at the beginning of the internet, there were haters too, people who said it wad all a fad. The eventual winners were the major web 2.0 plays, like $META, $MSFT and $AMZN. I suspect this time will be similar, with AI 2.0 analytics and web apps working in lucrative SAAS models into market, collecting gigantic sums of money.

But we still need to build the infrastructure and from my vantage point we have a solid 3 years of growth ahead of us, akin to 1997-2000.

Meanwhile:

USD higher, UST Yields higher,

Bond market vol. higher.

Not a good combination.

Either we get additional liquidity pretty soon or stocks may well swoon.

jog on

duc