- Joined

- 13 February 2006

- Posts

- 5,057

- Reactions

- 11,457

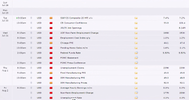

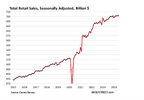

So the 'Retail Sales' number was out:

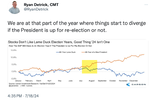

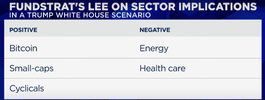

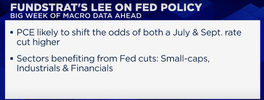

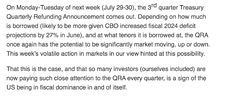

Trump, definitely the front runner now:

A weak USD is good for US stocks because it is good for UST markets and US debt loads.

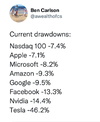

NVDA was (-7%+) at one point. Since I'm still short I am enjoying this.

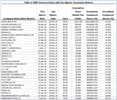

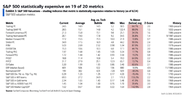

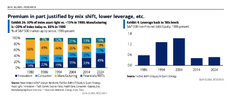

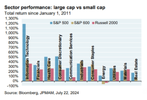

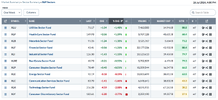

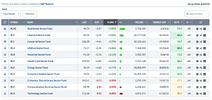

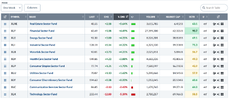

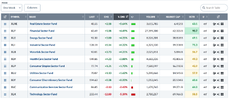

The point however is the bifurcated market:

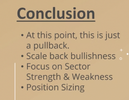

Confirmed

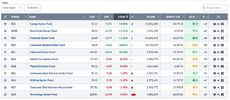

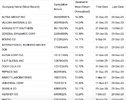

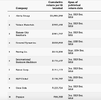

So for 1 week (Wednesday to Wednesday)

It would be good to know who exactly is driving this flippe-floppe. Hedge Funds?

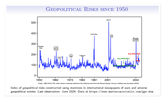

The macro situation:

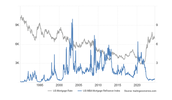

From the BIS Report:

The environment of higher interest rates further weakens fiscal positions that are already stretched by historically high debt levels. Indeed, the support from the negative gap between real interest rates and growth rates (that is, r–g) has shrunk in recent years, is projected to stay much smaller going forward and could even turn positive.

Curbing fiscal space further is rising public spending in the coming years, given the needs stemming from the green transition, pensions and healthcare, and defence.

Though financial market pricing points to only a small likelihood of public finance stress at present, confidence could quickly crumble if economic momentum weakens and an urgent need for public spending arises on both structural and cyclical fronts. Government bond markets would be hit first, but the strains could spread more broadly, as they have in the past.

Full: https://www.bis.org/publ/arpdf/ar2024e1.pdf

The above excerpt is the crux of the matter:

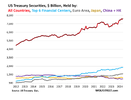

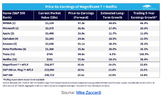

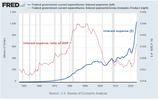

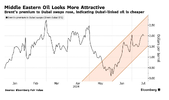

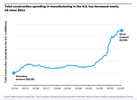

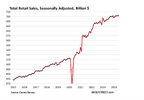

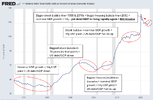

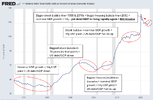

So this chart has GDP in blue, 10yr in red. GDP growth is higher.

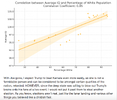

What has been the result?

Debt/GDP has increased. That is not SUPPOSED to happen.

Which is why the Treasury and Yellen NEED rate cuts. They need INFLATION to reduce the debt/GDP burden that is growing faster and faster as high interest rates (nominal) are too high in real terms for GDP, which has (and needs) an inflationary component to grow, to actually grow enough.

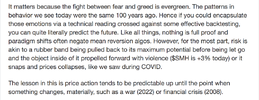

We will get inflation and lots of it because we need it. Well not us, but the powers that be. We'll pay it though.

Which is why cash will again become utter trash.

The only question is: will the inflation be hedged by stocks or not?

jog on

duc

Trump, definitely the front runner now:

A weak USD is good for US stocks because it is good for UST markets and US debt loads.

NVDA was (-7%+) at one point. Since I'm still short I am enjoying this.

The point however is the bifurcated market:

Confirmed

So for 1 week (Wednesday to Wednesday)

It would be good to know who exactly is driving this flippe-floppe. Hedge Funds?

The macro situation:

From the BIS Report:

The environment of higher interest rates further weakens fiscal positions that are already stretched by historically high debt levels. Indeed, the support from the negative gap between real interest rates and growth rates (that is, r–g) has shrunk in recent years, is projected to stay much smaller going forward and could even turn positive.

Curbing fiscal space further is rising public spending in the coming years, given the needs stemming from the green transition, pensions and healthcare, and defence.

Though financial market pricing points to only a small likelihood of public finance stress at present, confidence could quickly crumble if economic momentum weakens and an urgent need for public spending arises on both structural and cyclical fronts. Government bond markets would be hit first, but the strains could spread more broadly, as they have in the past.

Full: https://www.bis.org/publ/arpdf/ar2024e1.pdf

The above excerpt is the crux of the matter:

So this chart has GDP in blue, 10yr in red. GDP growth is higher.

What has been the result?

Debt/GDP has increased. That is not SUPPOSED to happen.

Which is why the Treasury and Yellen NEED rate cuts. They need INFLATION to reduce the debt/GDP burden that is growing faster and faster as high interest rates (nominal) are too high in real terms for GDP, which has (and needs) an inflationary component to grow, to actually grow enough.

We will get inflation and lots of it because we need it. Well not us, but the powers that be. We'll pay it though.

Which is why cash will again become utter trash.

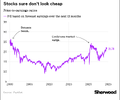

The only question is: will the inflation be hedged by stocks or not?

jog on

duc