- Joined

- 27 March 2008

- Posts

- 29

- Reactions

- 0

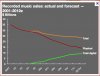

Thing about jb is that compared to Dick Smith and Harvey Norman it has the the high turnover small goods teen factor at the front door - music CDs. This has always given the stores a buzz. The CD market is now dead. JBs Model is no better than the others now apart from it's better prices which is going to be harder with internet sales etc

No wonder it is one of the most shorted stocks on the Asx at present at around $15

You may be right but, being a public company, the issue you are raising is one of materiality. If the impact of the CD market was likely to materially affect the business operations of JBH the management would be obliged to report it. The fact they have not and have not adjusted their earnings forecast for FY11 since March suggests this is not material at this stage.

I am convinced the chicken little effect is running ripe with this stock at present and am still buying shares at close to $15 and waiting to see their annual report in a few months time.