RichKid

PlanYourTrade > TradeYourPlan

- Joined

- 18 June 2004

- Posts

- 3,031

- Reactions

- 5

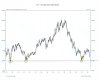

Re: US DOLLAR... a crystal clear outlook

Marc Faber recently said that the USD was doomed and that we should all frame copies of dollar bills to show our grandchildren. This particular debate started in a USD charting thread but has been moved here because of the wide ranging discussion.

If it didn't before it certainly would now (btw it did show bearish EW counts for those who don't follow EW).

Here's what Marc Faber thinks of it, quite a funny guy (my emphasis, not that you need it with picturesque words like his):

---------------

..............ALAN KOHLER: Did you notice that Steven Roach, the chief economist of Morgan Stanley, who has been a bear for a very long time, seems to have changed his tune now, saying he's feeling better about the world than for a long time. Do you think that the fact that Steve Roach has kind of thrown in the towel is a sell signal or do you think he's onto something?

MARC FABER: Well, Steve is a good friend of mine and he gave already a sell signal two years ago. He suddenly turned bullish about bonds and since then the bond market has been weak. And I agree with him that we are in a global boom but it doesn't change the fact that it is an imbalanced boom and it's driven largely by credit creation in the US, leading to overconsumption, leading to a growing trade deficit, current account deficit, the accumulation of reserves in Asia and a global boom. But it is nevertheless an imbalanced boom and one day there will be a problem, certainly with the US dollar. The US dollar is a doomed currency. Doomed? Doomed. Will be worthless. Actually each one of your listeners should buy one US Treasury bond and frame it - put it on the wall so they can show their grandchildren how the US dollar and how US dollar bonds became worthless as a result of monetary inflation.

ALAN KOHLER: You made at least three great calls - you warned of the 87 crash just before it happened, you warned investors to get out of Japan in 1990 and out of Asia in general in 1997. So what specifically is your call right now?

MARC FABER: I think we are in a bear market for financial assets. There's a bear market where the Dow Jones, say, would go from here - 11,000 to 33,000. It would go up in dollar terms but the dollar would collapse against, say gold or foreign currencies. That's what I think will happen with Mr Bernanke at the Fed because he has written papers and he has pronounced speeches in which he clearly says that the danger for the economy would be to have not deflation in the price of a fax machine or PC, but deflation in asset prices. And so I believe that he is a money printer. If I had been a university professor, I would not have let him pass his exams to become an economist. I would have said, "Learn an apprenticeship as a money printer."

ALAN KOHLER: (Laughs) So, a big mistake putting him in charge of the Fed then?

MARC FABER: I think it's very dangerous, very dangerous...........

http://www.abc.net.au/insidebusiness/content/2006/s1632456.htm

Marc Faber recently said that the USD was doomed and that we should all frame copies of dollar bills to show our grandchildren. This particular debate started in a USD charting thread but has been moved here because of the wide ranging discussion.

salz said:It shows the USD is on a downtrend aren't it?

If it didn't before it certainly would now (btw it did show bearish EW counts for those who don't follow EW).

Here's what Marc Faber thinks of it, quite a funny guy (my emphasis, not that you need it with picturesque words like his):

---------------

..............ALAN KOHLER: Did you notice that Steven Roach, the chief economist of Morgan Stanley, who has been a bear for a very long time, seems to have changed his tune now, saying he's feeling better about the world than for a long time. Do you think that the fact that Steve Roach has kind of thrown in the towel is a sell signal or do you think he's onto something?

MARC FABER: Well, Steve is a good friend of mine and he gave already a sell signal two years ago. He suddenly turned bullish about bonds and since then the bond market has been weak. And I agree with him that we are in a global boom but it doesn't change the fact that it is an imbalanced boom and it's driven largely by credit creation in the US, leading to overconsumption, leading to a growing trade deficit, current account deficit, the accumulation of reserves in Asia and a global boom. But it is nevertheless an imbalanced boom and one day there will be a problem, certainly with the US dollar. The US dollar is a doomed currency. Doomed? Doomed. Will be worthless. Actually each one of your listeners should buy one US Treasury bond and frame it - put it on the wall so they can show their grandchildren how the US dollar and how US dollar bonds became worthless as a result of monetary inflation.

ALAN KOHLER: You made at least three great calls - you warned of the 87 crash just before it happened, you warned investors to get out of Japan in 1990 and out of Asia in general in 1997. So what specifically is your call right now?

MARC FABER: I think we are in a bear market for financial assets. There's a bear market where the Dow Jones, say, would go from here - 11,000 to 33,000. It would go up in dollar terms but the dollar would collapse against, say gold or foreign currencies. That's what I think will happen with Mr Bernanke at the Fed because he has written papers and he has pronounced speeches in which he clearly says that the danger for the economy would be to have not deflation in the price of a fax machine or PC, but deflation in asset prices. And so I believe that he is a money printer. If I had been a university professor, I would not have let him pass his exams to become an economist. I would have said, "Learn an apprenticeship as a money printer."

ALAN KOHLER: (Laughs) So, a big mistake putting him in charge of the Fed then?

MARC FABER: I think it's very dangerous, very dangerous...........

http://www.abc.net.au/insidebusiness/content/2006/s1632456.htm