- Joined

- 8 June 2008

- Posts

- 13,398

- Reactions

- 19,825

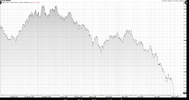

Africa is key in China’s bid to de-risk its iron ore supply

In a bid to break its reliance on Australia and Brazil for iron ore, China is diversifying further afield.

I think we can thanks Biden for that and the Ukrainian war.

If politics can be above laws and economic interest among the US allies, no point pretending we have rules ...

So we can burn as much green h2 as we want, will change nothing with our customers.

Remember this is as valid for India

Another suicidal approach of the west, this time economical

Edited to add India case and correct mangled typost