- Joined

- 30 June 2008

- Posts

- 15,667

- Reactions

- 7,518

SciDev is developing the chemistry and process control for solids-liquid separation. It brings in technology and manufacturing capabilities to solve environmental issues for the mining, construction, and water treatment markets. The company is specifically focused on fine particle separation chemistry (colloid chemistry), which is reported to be a US$11 billion sector within the broader US$100 billion global commodity chemistry market. Recent significant contract wins include Shell, Melbourne Metro, and a field validation work for BHP at Olympic Dam copper mine.

Its latest financials show a 23 per cent increase in 1H FY21 gross profit, and its share price has shot up almost 150 per cent over the past year.

Papyrus develops technology that converts the waste trunk of the banana palm into products used in the packaging, furniture, and construction industries. The company says its products have qualities not found in existing wood-based products, due to the ability to preserve the inherent natural qualities of the banana tree trunk.

The focus of the company in the past year has been to expand its Papyrus Egypt business, and apply its know-how in a developing country where bananas are grown. The company has also had success in Japan, exporting its veneer products to the Yamaha musical instruments manufacturers, as well as a recent licensing agreement in China for its technology.

The latest half year of FY21 shows $0.18 million profit before tax. Its share price has surged by 360 per cent over the past 12 months.

RAN is a manufacturer of recycled plastic pallets. Its thermo-fusion technology allows it to make plastic pallets from 100% recycled mixed waste plastic, at a price that is competitive with wood pallets. It currently has four production lines operating in Indonesia, and sells its pallets under the brand Re>Pal.

he company says its pallets are a sustainable alternative to timber, which subsequently reduces deforestation. Deforestation is especially a major problem in Indonesia, and the government there has banned logging of primary forest to supply wood for pallets. RAN aims to take advantage of these developments.

The company delivered a net loss for the full FY20 of $3 mlllion, which was a substantial improvement from its $9.2 million loss in 2019. Its share price has surged by 130 per cent over the past year.

Pearl focuses on the environmental technology for the waste tyre industry. It applies thermal desorption technology to convert end-of-life tyres into valuable secondary products such as fuel oil, steel, carbon char and energy. It’s the first Australian company licensed to thermally treat tyres, after the government banned the export of waste tyres.

The company says it’s serving a large addressable market, with 1.6 billion tyres discarded globally every year, of which Australia makes up 56 million. Pearl says it has processed over 1 million tyres to date at its Stapylton facility.

Revenues for the FY21 half show a 40 per cent increase to $1.5 million, for a net loss of $4.1 million. It share price has risen by 6 per cent in the past year.

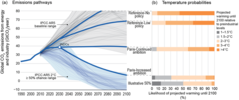

bringing the thread back on its original purpose .... which when Investment Implications of Climate Change merges with Aussie Stock Forums tends to point towards talking about ASX stocks that are positioned for adaption, whether it be emerging technologies or whatever,...

Will also be interesting to see the impact of their findings on stock market investments.

Will also be interesting to see the impact of their findings on stock market investments.

Political debate and so on aside, it's a practical reality that pretty much everything built by humans was built with the climate as an influence.Very good overview of the implications raised in terms of investor losses, building policy changes and insurance cover.

There's certainly been a good trading opportunity with some of them, no question there.I thought coal stocks were way oversold

I am thinking exactly the same, even if CC is real, sooner or later, the reality will have to take over the narrative, so our government will have slowed down new oil explorations, coal mines etc while the demand will continue unabated..perfect conditions for an increase of price.There's certainly been a good trading opportunity with some of them, no question there.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.