CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

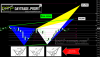

Interesting how the risk/off/risk/on type trades are consolidating while the indices get have the bid. So Gold has broken out, the 6A looks ready to make a move...RBA i suppose, the Bonds are ready to move higher on any poor data and the Yen looks ready for a pop higher....btw the measured move for GC is 1356