CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

one for the intra day traders out there:

In a raging bull market does your set up and trading style change?

I'm not saying we are running into a bull But recent events have got me thinking that at some stage we will. I feel in the last 2-3 years of atleast having some exposure to intra day mkts (but no success mind you) I've seen grinds higher, consolidations and bear periods. I feel my 'playbook' atleast has some pages for each of these themes, ranging from looking for a fake out every time in a quiet mkt to sacking up and selling the first bar in strong bear.

Traditionally I feel good sell trades rarely 'retest' and move quickly. Hard to get on and violent movements. Alternatively most (not all) bull opportunities provide some type of decent confluence to get in. Basing patterns, certain times of the day, retests etc.

Now I'm wondering if this view is perhaps warped by the fact I haven't witness all mkt themes?

In a raging bull is it just close your eyes and buy buy buy?

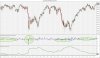

A couple of my observations/thoughts about bull markets compared to bear markets....in Bull markets , prices move up slower because punters like to hang onto profits, where as in bear markets, prices decline swiftly as fear sets in, so the theory goes. So from my point of view 'value' as expressed by the most highly traded price should be constantly accepted higher through consolidations (Brackets) and breakouts. An aging trend should have value area grinding higher as the auction struggles to attract more bidders. I should be able to illustrate this using my TPO momentum indicator. Also, we can plot an ATR to show lowering volatility as the market accepts higher value in bull markets and higher volatility as the market searches for value lower during bear markets...

So what should we expect from intra-day price action during bull markets? I think it would mean more rotational days, narrower ranges, fewer large range extensions. Some nice short covering rallies, as well as a few good breaks as longs liquidate but some solid excess lows where lower prices are firmly rejected at the value area highs of previous brackets.

The average daily range is shrinking in a bull market, so is the opportunity for large moves. Perhaps larger size and smaller targets should be considered, rather than smaller size and bigger targets...

The chart shows the ATR as a measure of volatility and the TPO momentum which shows the change in the 'most agreed' price of the day, as defined by the amount of time it spends at that price, not volume.

This is a really interesting topic and the above are only my thoughts in answer to your question. I would love to be able to quantify it more. An interesting note on quantifying this type of thing, i found through extensive testing of an open range breakout system (SPI) that during bear markets the opening 5-10 minute range could be traded quite profitably, presumably because of the gaps. Going back over time, it worked better in very volatile markets, for obvious reasons, urgency and fear.