skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

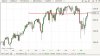

US market at a key juncture now.

Back in September with ES ~1900 level, I remember telling myself "Don't short now, it will most likely retest the level where it broke down".

Well, 2040 was the that level... and we are right there. It means we are only 5% down from all time high.

The question is:

1. Do you short the market now?

2. Do you wait for a reversal back below 2000?

3. Do you wait for the Fed meeting on 27/28 Oct?

It feels like no one trust this rally (as indicated by everyone panicking on the first sign of it ending back in late Aug), yet everyone still want to be part of it. Sort of like you have to keep dancing as long as the music is playing.

Back in September with ES ~1900 level, I remember telling myself "Don't short now, it will most likely retest the level where it broke down".

Well, 2040 was the that level... and we are right there. It means we are only 5% down from all time high.

The question is:

1. Do you short the market now?

2. Do you wait for a reversal back below 2000?

3. Do you wait for the Fed meeting on 27/28 Oct?

It feels like no one trust this rally (as indicated by everyone panicking on the first sign of it ending back in late Aug), yet everyone still want to be part of it. Sort of like you have to keep dancing as long as the music is playing.