- Joined

- 10 June 2007

- Posts

- 4,045

- Reactions

- 1,404

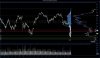

Pretty nasty sell off going on, must be down 10% since Monday

I certainly didn't get the setup for a short covering rally and don't think i will this week...

yeah, spx cash futes just broke retested yesterdays cash pivot....a shift....

...isnt September worst month of all months for longs?

lol, can never tell if US always manages to hold up for highs and hold down to lows into ops expiration thurs/fridays

edit

More than 100 years of data show that the worst month for stocks is September

ha! ...and guess who put out these numbers

http://www.elliottwave.com/freeupda...Months-October-Think-Again.aspx#axzz3jLirGDA1