skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

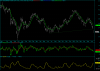

Yerp! and if you're a long time ZH reader, you will notice that the last time Chinese interbank yields were spiking like this was 2010, right when the Shanghai Comp was running ~3100.

Actually I first saw this mentioned in Charlie Aitken's email so I thought Zerohedge would definitely have something on it. It was just easier to post ZH's link as Charlie doesn't seem to like people re-telling his thoughts.

I used to read ZH a fair bit but now I only go there when I want to look for specific topics. Reading ZH too much is definitely bad for going long in anything (except gold, of course).