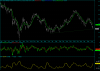

Extremely low liquidity tonight on the EURUSD, even for a Monday.

Single trade for the day was a long on the EURUSD, exited at 1:1 R on expectations of small moves, price managed to jump another R after a retrace though. I'm not comlaining, considering the crappy liquidity.

Starting to look pretty distributiony on the hourly chart there. Time for a relief rally in the USDX?

Single trade for the day was a long on the EURUSD, exited at 1:1 R on expectations of small moves, price managed to jump another R after a retrace though. I'm not comlaining, considering the crappy liquidity.

Starting to look pretty distributiony on the hourly chart there. Time for a relief rally in the USDX?