- Joined

- 3 November 2013

- Posts

- 1,590

- Reactions

- 2,827

Australian GDP at 0.2%... Pretty much negative once they revise downwards

The ABS says that it was 2.1% in nominal terms, so I guess that is after "seasonal adjustments".Australian GDP at 0.2%... Pretty much negative once they revise downwards

from ABC News

from ABC NewsThe household saving ratio fell to 3.7 per cent in the March quarter, from 4.4 per cent.

It is sitting at the lowest level since the June quarter 2008, which was during the global financial crisis.

"The household saving ratio fell to its lowest level in nearly 15 years," Ms Keenan said.

Another thing I take from this is consumers are fundamentally irrational. What they say, what the really think, and what they do are all very different things.This is another sector that members need to be wary of, single use clothing, it is a huge trend in todays younger generation but not only will tighter spending affect it, but also legislation is in the wind.

I can't think of where else to post it, as it will be hit by consumer spending tightening and also Governments are clamping down on it.

Meanwhile:

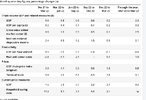

View attachment 157294

Superior goods.

Quite a good bit of analysis done by some, well, analysts on this: They've taken a look at both the financials of the companies and what deals they've made with what payment providers and what percentage of their sales are being made on/with what payment methods and so on and so forth and wouldn't you know it, a lot, like a LOT of sales have been made on credit - credit cards, buy now pay later providers, all that kind of stuff, and it's THOSE sales that have plummeted in the recent quarterly results.

The "boom" we saw in so much of this frivolous BS was hugely credit driven. Classic case of the financially irresponsible (fake people) using credit to try to make themselves appear to have a lot more money than they really do. Consumerism at its core.

Now don't get me wrong, I (and plenty of others) predicted months ago that consumer goods sales would plummet and services demand (holidays, theme parks, casinos, comedy shows etc etc) would skyrocket once the world started reopening and that's *exactly* what has happened but it's just interesting to note how so much of these luxury brand sales have been made with money people just simply did not have.

It'd be very interesting to take a look at what percentage of sales of services (the aforementioned holidays, theme parks, live theatre etc etc) are being made on credit. To my mind they just aren't the kind of thing you use credit to pay for (I've only ever used credit to cover some kind of unexpected expense that's been more than what I keep in my everyday account) but you can use afterpay to buy-now-pay-later a domino's freaking pizza now so maybe I'm just underestimating how absurd this BNPL craze is actually going to get.

If they're being bought with credit too then it's only a matter of time before the demand for services, like consumer goods before it, falls off a cliff as well.

Food for thought.

was waiting to see if the more logical 0.4% ( considering where we are first ) was a hike near-termAnyone for a 0.5% interest rise either next time, or the time after?

Alright smurf, here's some irrationality:

"These brands specifically target people they know cannot afford them".

Lol. It's almost as if the companies know why people want their ****/what kind of people want their ****.

I am a bit of the opposite, cash in my wallet seems like lazy money just there to be spent guilt free, so it’s easy to give it away.When dealing with plastic and not cash is the problem. No concept of how much sits in the wallet.

Only problem there is the new eneration generally don't know the value of a dollar.I am a bit of the opposite, cash in my wallet seems like lazy money just there to be spent guilt free, so it’s easy to give it away.

But cash in the bank is in my offset account earning interest working for me, spending that seems like giving away real money that sh ok I’d be working for me.

With the ease of checking your balance through phone apps, right on the phone you are using to pay with, I am not sure the new generation sees much difference between cash and digital payments.

Yep the Government has its foot to the floor on the accelerator, while asking the RBA why it can't slow down the car, clown world for sure. ?

We were in the Midland Gate shopping centre for lunch a couple of days ago.Yep the Government has its foot to the floor on the accelerator, while asking the RBA why it can't slow down the car, clown world for sure. ?

Maybe the government should concentrate on the housing crisis, that is going to cause some really serious social issues very soon IMO. This is becoming a very serious issue and I don't think the Canberra bubble is aware of how it could blow up in their faces, time will tell.

The real problem is people are beginning to expect the Govt to fix it for them, when in reality they are making it worse for them, the longer the Govt takes to NO, the bigger the backlasd will be.

Yo Farmer, do you recall what was the demographic of these people?We were in the Midlanf Gate shopping centre for lunch a coupel of days ago.

Wouldn't have thought that too many people are concerned about inflation.

Food hall pretty full ie 11.30am, struggled to find 2 chairs together and the shops on the fringe had people coming and going while were hoeing into Chinese tucker.

The daughter who is a low income worker, is still giving the two grandsons lunch money, instead of making them sandwiches.We were in the Midlanf Gate shopping centre for lunch a coupel of days ago.

Wouldn't have thought that too many people are concerned about inflation.

Food hall pretty full ie 11.30am, struggled to find 2 chairs together and the shops on the fringe had people coming and going while were hoeing into Chinese tucker.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.