over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,291

- Reactions

- 7,509

Sure that's the degen play, but I don't think they've been shifting bonds lolWho do you think was buying all of these:

View attachment 150481

"There is a lot more demand to trade and carry option positions in SPY than normal".

Open interest way above normal (**** me, it's 20% above normal...) means only one thing

One begets the otherSure that's the degen play, but I don't think they've been shifting bonds lol

Here's why I would still be nervous if I was him:

View attachment 150479

Remember that this is just the rig count too, not the flow rate. Rigs flow their fastest at the beginning and then the rate tapers off over time:

View attachment 150480

So take a ~1m barrels/day shortfall and then factor in how much they've diverted/are still trying to divert to europe to replace the russian supply too and there's a biiiig problem.

Yes, that's what immigration policy is for - importing cheap labour.Are they going to create/import more workers?

Yes, that's what immigration policy is for - importing cheap labour.

Anywhere they canFrom where? The US has been open for the past year

are you sure they are inept ( rather than disingenuous ) after all their major , most frequently used tool is 'the jawbone 'I'll give you inept, but irrelevant?

depends if the drugs they are trafficking goes up as well , if the price of illegal drugs was to fall ( or god forbid , they start importing cheap generic prescription pharmaceuticals flooding the markets in that sector ) that might be deflationaryFrom where? The US has been open for the past year. And wouldn't immigration contribute to inflation?

“We wouldn’t…try to crash the economy and then clean up afterwards,” Chairman Powell recently remarked. “I wouldn’t take that approach at all.” Yet that is, in fact, what every other Fed Chair has done during predictable yield‐curve‐inversion recessions.

In October I wrote, “CPI Less Rent Was Zero for 3 Months; CPI Rent Is Wrong.”

Nobody appeared to find that interesting.

Now, CPI less rent has shown zero inflation for 5 months.

How long can zero remain uninteresting?

Some prices went up over the past five months and others went down, but the weighted average increase for everything in the average consumer’s shopping basket was nil once we properly exclude disingenuous and outdated estimates of shelter inflation.

Not sure if this guy is right on the second comment but the first is on the money and I expect it will occur again.

Forced hard landing either by design or ineptitude.

https://www.cato.org/blog/history-cautions-against-loosening-fed-policy-too-late-3

Bingo, read twice lads, bottle is on the money. PPI below estimates but CPI above them means it's labour driven.To paraphrase Jpowell: it's services, not goods, that are still driving inflation. And that's being driven by a tight labour market.

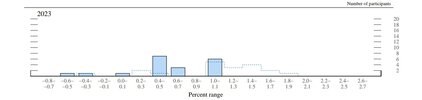

The Fed is now expecting US unemployment to head up in 2023 from a median 3.7% in 2022 to 4.6% in 2023, 2024 and 4.5% in 2025. Meanwhile GDP is heading down in 2023 to a median 0.5% - look at the distribution, obviously some on the board who expect it to be negative following revisions from only 3 months earlier.

View attachment 150494

To top it all off they're going to hike a further ~100bps.

So you've got negative GDP, job losses and tighter monetary conditions. How does this happen without a recession?

Fully agree there. Looking ahead (2023) I do think a "hard landing" is extremely likely and I expect the Fed's fully aware of this, just not saying it publicly.So you've got negative GDP, job losses and tighter monetary conditions. How does this happen without a recession?

I'll give you inept, but irrelevant?

alhambrapartners.com

alhambrapartners.com

Markets have swung wildly just on st jerome's comments and perception = reality in this business.Utterly.

Why The Fed’s Balance Sheet Reduction Is As Irrelevant As Its Expansion

The FOMC is widely expected to vote in favor of reducing the system’s balance sheet this week. The possibility has been called historic and momentous, though it may be for reasons that aren’t very kind to these central bankers. Having started to swell almost ten years ago, it’s a big deal only inalhambrapartners.com

Markets have swung wildly just on st jerome's comments and perception = reality in this business.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.