Insiders Selling Stocks at Highest Level Since May 2008

Insiders Selling Stocks at Highest Level Since May 2008

Washington’s Blog

Monday, August 31, 2009

Best buying opportunity since the Great Depression?

TrimTabs is reporting that insiders know better:

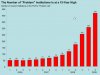

Selling by corporate insiders in August has surged to $6.1 billion, the

highest amount since May 2008. The ratio of insider selling to insider buying

hit 30.6, the highest level since TrimTabs began tracking the data in 2004.

“The best-informed market participants are sending a clear signal that the

party on Wall Street is going to end soon,” said Charles Biderman, CEO of

TrimTabs.

TrimTabs explained that insider activity is not the only sign the rally is

about to end. The TrimTabs Demand Index, which tracks 18 fund flow and sentiment

indicators, has turned very bearish for the first time since March.

For example, short interest on NYSE stocks plummeted by 10.3% in the second

half of July and margin debt on all US listed stocks spiked 5.9% in July, while

51.6% of advisors surveyed by Investors Intelligence are bullish, the highest

level since December 2007.

“When corporate insiders are bailing, the shorts are covering and investors

are borrowing to buy, it generally pays to be a seller rather than a buyer of

stock,” said Biderman.

TrimTabs also reports that the actions of U.S. public companies have been

bearish. In the past four months, companies have been net sellers of a record

$105.2 billion in shares.

“Investors who think the U.S. economy is recovering are going to get a big

shock this fall,” said Biderman. “Companies and corporate insiders are signaling

that the economy is in much worse shape than conventional wisdom believes.”

http://www.prisonplanet.com/insiders-selling-stocks-at-highest-level-since-may-2008.html

Insiders Selling Stocks at Highest Level Since May 2008

Washington’s Blog

Monday, August 31, 2009

Best buying opportunity since the Great Depression?

TrimTabs is reporting that insiders know better:

Selling by corporate insiders in August has surged to $6.1 billion, the

highest amount since May 2008. The ratio of insider selling to insider buying

hit 30.6, the highest level since TrimTabs began tracking the data in 2004.

“The best-informed market participants are sending a clear signal that the

party on Wall Street is going to end soon,” said Charles Biderman, CEO of

TrimTabs.

TrimTabs explained that insider activity is not the only sign the rally is

about to end. The TrimTabs Demand Index, which tracks 18 fund flow and sentiment

indicators, has turned very bearish for the first time since March.

For example, short interest on NYSE stocks plummeted by 10.3% in the second

half of July and margin debt on all US listed stocks spiked 5.9% in July, while

51.6% of advisors surveyed by Investors Intelligence are bullish, the highest

level since December 2007.

“When corporate insiders are bailing, the shorts are covering and investors

are borrowing to buy, it generally pays to be a seller rather than a buyer of

stock,” said Biderman.

TrimTabs also reports that the actions of U.S. public companies have been

bearish. In the past four months, companies have been net sellers of a record

$105.2 billion in shares.

“Investors who think the U.S. economy is recovering are going to get a big

shock this fall,” said Biderman. “Companies and corporate insiders are signaling

that the economy is in much worse shape than conventional wisdom believes.”

http://www.prisonplanet.com/insiders-selling-stocks-at-highest-level-since-may-2008.html