You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Imminent and severe market correction

- Thread starter Uncle Festivus

- Start date

And the market rallied 6.54% on-

http://www.marketwatch.com/

NEW YORK (MarketWatch) -- U.S. stocks on Friday rallied on a report President-elect Barack Obama would nominate Timothy Geithner to be the nation's Treasury secretary.

"The market's message is Geithner is a good choice. He's young, he's intelligent and he's experienced. What this country needs are people who are young, full of energy, and can put in 26-hour days. There's nothing like leverage," said Hugh Johnson, chairman of Johnson Illington Advisors

http://www.marketwatch.com/

US looking for any excuse to have a rally. Timothy Geithner is the messiah, the reason for the rally, the reason the market turned, the reason again all other poor data overlooked. This guy must be good because he works 26 hour days. He has also been beside Ben Bernanke throughout the crisis-wow. Genuine rally?

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,418

- Reactions

- 11,819

Any reason could have driven the market today. I think it's just a technical bounce. Or, maybe a sustained rally? Just how much is factored in will be disclosed later...US looking for any excuse to have a rally. Timothy Geithner is the messiah, the reason for the rally, the reason the market turned, the reason again all other poor data overlooked. This guy must be good because he works 26 hour days. He has also been beside Ben Bernanke throughout the crisis-wow. Genuine rally?

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

Any reason could have driven the market today. I think it's just a technical bounce. Or, maybe a sustained rally? Just how much is factored in will be disclosed later...

From Cuck Butler, Everbank

Investors fled stocks and moved back into dollars throughout the trading day yesterday, rallying the dollar index back to the highest level since April 2006. We moved above 88 on the dollar index a week ago, but it was unable to maintain the higher level.

The same thing occurred last night, as equity markets in Asia rebounded, bringing the dollar index back below the 88 handle. Apparently there was speculation that a sale of Citigroup Inc. will reduce risk in the financial system, slightly increasing the confidence of investors. This is how perverse these markets have become; the possible sale of one of the largest financial firms in the US actually rallies the markets.

It is a crazy world out there and the market players dont' know where to go but in desperation are going and following anything that seems to move. I think the lateness of the move up looks a lot like Fed money to me, who can tell?

IFocus

You are arguing with a Galah

- Joined

- 8 September 2006

- Posts

- 7,693

- Reactions

- 4,802

The Real Great Depression

By SCOTT REYNOLDS NELSON

While many commentators on the recent mortgage and banking crisis have drawn parallels to the Great Depression of 1929, that comparison is not particularly apt. Two years ago, I began research on the Panic of 1873, an event of some interest to my colleagues in American business and labor history but probably unknown to everyone else. But as I turn the crank on the microfilm reader, I have been hearing weird echoes of recent events.

http://chronicle.com/temp/reprint.php?id=477k3d8mh2wmtpc4b6h07p4hy9z83x18

By SCOTT REYNOLDS NELSON

While many commentators on the recent mortgage and banking crisis have drawn parallels to the Great Depression of 1929, that comparison is not particularly apt. Two years ago, I began research on the Panic of 1873, an event of some interest to my colleagues in American business and labor history but probably unknown to everyone else. But as I turn the crank on the microfilm reader, I have been hearing weird echoes of recent events.

http://chronicle.com/temp/reprint.php?id=477k3d8mh2wmtpc4b6h07p4hy9z83x18

Any reason could have driven the market today. I think it's just a technical bounce. Or, maybe a sustained rally? Just how much is factored in will be disclosed later...

How big will the rally be when Obama names a new SEC chairman?

The Real Great Depression

By SCOTT REYNOLDS NELSON

While many commentators on the recent mortgage and banking crisis have drawn parallels to the Great Depression of 1929, that comparison is not particularly apt. Two years ago, I began research on the Panic of 1873, an event of some interest to my colleagues in American business and labor history but probably unknown to everyone else. But as I turn the crank on the microfilm reader, I have been hearing weird echoes of recent events.

http://chronicle.com/temp/reprint.php?id=477k3d8mh2wmtpc4b6h07p4hy9z83x18

Hey IFocus, that is a VERY interesting read! The points of note that stood out to me were;

1. the fact that it was US industry taking over Europe then, and now it's China taking over the US

2. The post-panic winners, even after the bailout, might be those firms ”” financial and otherwise ”” that have substantial cash reserves.

As far as the correction goes, it seems to me that once the Citi and auto makers issues are sorted out one way or another, we should see the end of the correction.

My reasoning would be that given that Citi is the largest bank in the US, they are not going to be allowed to go under, at least that is my understanding of the purpose of the bailout. Whatever happens, once it is resolved that would bring much more certainty to the market as it would be a model for what would most likely happen when other smaller players get into trouble as well.

The automakers are a slightly different case as they are more an emotional attachment for the US. If they go under, the DOW will obviously go much lower (maybe another 1000); if they get bailed out, the DOW should stabilise. Regardless, once the situation is resolved, we should see the extent of the correction reached. IMO of course (not that I know much

And the market rallied 6.54% on-

...There's nothing like leverage," said Hugh Johnson, chairman of Johnson Illington Advisors

aye its done wonders for the global financial system.

Hey IFocus, that is a VERY interesting read! The points of note that stood out to me were;

1. the fact that it was US industry taking over Europe then, and now it's China taking over the US

2. The post-panic winners, even after the bailout, might be those firms ”” financial and otherwise ”” that have substantial cash reserves.

I read it too, thanks for posting IFocus. So what you're saying jono is invest in Chinese financials, automakers and other commodity producers?

chops_a_must

Printing My Own Money

- Joined

- 1 November 2006

- Posts

- 4,636

- Reactions

- 3

aye its done wonders for the global financial system.

Hahahaha...

The contrary indicators for cynicism are going off like there's no tomorrow on ASF lately.

Glen48

Money can't buy Poverty

- Joined

- 4 September 2008

- Posts

- 2,444

- Reactions

- 3

I see in Honkers Rollers and Bentley's are now down to 38K up market apartments have takes a dive

- Joined

- 12 December 2006

- Posts

- 289

- Reactions

- 0

http://www.nakedcapitalism.com/2008/11/chinas-smoot-hawley.html

Very interesting read!

The solution to this is for the Renminbi to appreciate and for China to consume and pull the rest of the world out of the deepening hole we find ourselves in..

basically the standards of living must move in opposite directions...

makes sense right?

did you all see the news today? unionized auto industry workers in the US get paid US$73/hr incl benefits... that is around 208k AUD per annum at the current exchange rate plus super.

sustainable?

Very interesting read!

The solution to this is for the Renminbi to appreciate and for China to consume and pull the rest of the world out of the deepening hole we find ourselves in..

basically the standards of living must move in opposite directions...

makes sense right?

did you all see the news today? unionized auto industry workers in the US get paid US$73/hr incl benefits... that is around 208k AUD per annum at the current exchange rate plus super.

sustainable?

>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

check this out for getting it right.

http://au.youtube.com/watch?v=2I0QN-FYkpw

unfreakin believable!

http://au.youtube.com/watch?v=2I0QN-FYkpw

unfreakin believable!

- Joined

- 12 December 2006

- Posts

- 289

- Reactions

- 0

many people saw this coming.. incl me

most in the industry making big money from it all couldnt admit the party was going to finish.. with a big hangover monday morning

now going forward.. Marc Faber from 21 Nov 2008 talking about the future...

http://au.youtube.com/watch?v=UDsaUD5KPdE

most in the industry making big money from it all couldnt admit the party was going to finish.. with a big hangover monday morning

now going forward.. Marc Faber from 21 Nov 2008 talking about the future...

http://au.youtube.com/watch?v=UDsaUD5KPdE

Citi's in serious trouble and "too big to fall."

Then there is the question of GE's viability.If it is in trouble then there will be more than one cat amongst the pigeons.

http://www.minyanville.com/articles/WMT-LOW-GE-Credit-recession-depression/index/a/20014

Citi's common stock is now worth less than the government pumped into the company last month. (On the bright side, if the government hadn't pumped in the money, it would now be worth zero). The company's tangible book to equity ratio is now more than 50-to-1, and the firm's gigantic mountain of consumer debt "assets" will almost certainly face enough writedowns in the next several quarters to wipe out the equity that's left

http://clusterstock.alleyinsider.com/2008/11/citigroup-finally-panicsWhatever happens, Citigroup won't declare bankruptcy. Before that happens, Hank Paulson will take it over, just as he did Fannie and Freddie. He will then chop it up and start selling off the pieces to try to recoup some of the $2 trillion that taxpayers will be on the hook for.

Citi's debtholders will probably be kept whole in that scenario (Hank won't risk another Lehman). Citi's preferred shareholders will probably get hit but not vaporized. Citi's common shareholders, meanwhile, will probably get wiped out.

Then there is the question of GE's viability.If it is in trouble then there will be more than one cat amongst the pigeons.

http://www.minyanville.com/articles/WMT-LOW-GE-Credit-recession-depression/index/a/20014

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,198

Citi's in serious trouble and "too big to fall."

QUOTE]

No one is too big to fall anymore. Pundits I read used to say "we live in interesting times" now we see comments as "we live in atonishing times"

Hi peoples,

I was searching through the drivel on youtube trying to find some decent commentary from October, came across this

http://www.youtube.com/watch?v=Xz-dgLxWEg4&feature=related

It's labelled Pete Schiffr on Glenn Beck (which he has been on a few times) and it's got lots of sarcastic commentary etc and Peter Schiff being a prick as usual which you can probably safely ignore, but the so called diamond in the rough is the commentary from ex-big-cheese of the St. Louis fed. He has some interesting things to say.

I was searching through the drivel on youtube trying to find some decent commentary from October, came across this

http://www.youtube.com/watch?v=Xz-dgLxWEg4&feature=related

It's labelled Pete Schiffr on Glenn Beck (which he has been on a few times) and it's got lots of sarcastic commentary etc and Peter Schiff being a prick as usual which you can probably safely ignore, but the so called diamond in the rough is the commentary from ex-big-cheese of the St. Louis fed. He has some interesting things to say.

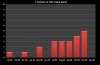

This is starting to be a regular event on Friday after the market closes in the US.

Is there a trend developing here?

The trend continues with another 3 US bank failures on Friday.

Attachments

- Joined

- 10 July 2004

- Posts

- 2,913

- Reactions

- 3

The trend continues with another 3 US bank failures on Friday.

In that case, current illogical "free market" logic will probably result in a Tsunami wave of optimistic panic buying...... especially so with the Great God Of Free Markets (GWB) proclaiming he is gonna build some sort of "shrine" in Texass to the ideals of "free markets, freedom and democracy".

Wheeee!

Go figure.

aj

Similar threads

- Replies

- 184

- Views

- 9K

- Replies

- 7

- Views

- 2K

- Replies

- 587

- Views

- 75K