So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,469

- Reactions

- 1,475

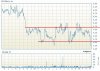

Iluka is approaching a new 12 month (52-wk Low 3.04) and near 10 year low after

announcing that it will reduce production due to weak demand for its major products

thus far in 2009.

http://www.iluka.com/Default.aspx?page=130&did=453

So will ILU bounce now as it always seems to do, or can it go much lower, i would think

that "on paper" there is more SP downside...but the SP seems to be super resilient...at

least that's been the case so far...resilient as in no big March09 sell off and the Oct/Nov08

low coincided with the big (WA) interruption to gas supply and resulting reduced production.

Perhaps some of the long term holders will be tempted to bail now as there's been no

dividend sine 06 and looks to be a few years yet till ILU would be in a position to pay a

dividend again.

Would seem to be a great channel trading opportunity. :dunno:

announcing that it will reduce production due to weak demand for its major products

thus far in 2009.

http://www.iluka.com/Default.aspx?page=130&did=453

So will ILU bounce now as it always seems to do, or can it go much lower, i would think

that "on paper" there is more SP downside...but the SP seems to be super resilient...at

least that's been the case so far...resilient as in no big March09 sell off and the Oct/Nov08

low coincided with the big (WA) interruption to gas supply and resulting reduced production.

Perhaps some of the long term holders will be tempted to bail now as there's been no

dividend sine 06 and looks to be a few years yet till ILU would be in a position to pay a

dividend again.

Would seem to be a great channel trading opportunity. :dunno: