nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

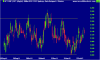

$3.16 appears to have turned into a level of resistance. While gpt bounced back nicely after going exdiv (after testing some exagerated lows), it seems to be struggling to get through $3.16.

Opened today at $3.15, tested $3.16 for a short while then the sellers built up and pushed it steadily down to $3.12. At one point, in the closing auction, it looked like closing on $3.11 however buyers jumped in with seconds to spare and pushed the closing price back to $3.13.

Can't see why gpt is under such a strangle hold when the likes of Dexus, CPA and IOF are trading in the higher ranges of their price channels. IMO, if it drops back much further it will present further trade oportunities. As always DYOR.

Opened today at $3.15, tested $3.16 for a short while then the sellers built up and pushed it steadily down to $3.12. At one point, in the closing auction, it looked like closing on $3.11 however buyers jumped in with seconds to spare and pushed the closing price back to $3.13.

Can't see why gpt is under such a strangle hold when the likes of Dexus, CPA and IOF are trading in the higher ranges of their price channels. IMO, if it drops back much further it will present further trade oportunities. As always DYOR.