- Joined

- 8 March 2007

- Posts

- 2,976

- Reactions

- 4,145

Will do over the week-endCan you help me with that Capt?

Will do over the week-endCan you help me with that Capt?

Can you help me with that Capt?

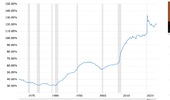

Sailing for SILVER by Comparison to GOLD

View attachment 186149

It is always good to dream. You mentioned in an earlier post Sean of considering when to sell your PM accumulations. The following is a suggestion in jest as to how to spend it from a Powerball investor.

Ahoy there Ducati 916

I love your work !

All I ask "Do you think Bitcoin/Trump will ONE DAY Sink GOLD into IRREVALENCE in the Very Near Future?"

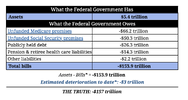

View attachment 186368

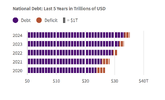

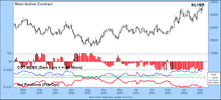

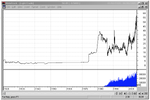

We haven't had an update on the POG for nearly a week heading in to an election in the USA which whatever way it falls will elect a muppet to rule that country for the next 4 years. Any old way it falls we are looking at volatility in all assets and Gold will be no exception. So what has happened to Gold in the past month leading up to this choice of one fool over another to be POTUS. ?

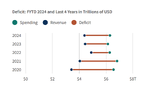

The BRICS meeting has come and gone and as one would expect the rumour won out over the event with Gold rising a handy $100 prior to the event and then falling back to support at $USD 2750. Volume which had been rising all year has likewise paused. everyone is waiting for the result of the US election which will make no goddam difference to anything really. We will swap a demented Biden for either a nothingburger Harris or a mad Trump. What will change? I'd prefer a maddie as it will provide more volatility for the POG. The Semitic cousins in Israel and Palestine (and now Lebanon, slowly it creeps) continue to bomb the bejaysus out of each other mainly over a belief in the power of land and the after-life. The former makes much sense so the killing will continue. Putin, Xi and the other heavies will continue to inflict as much pain on the world as Biden did and nationalism is rising. Some low IQ fools are talking about tying the $USD to Gold which ain't going to happen just as the low IQ and lazy countries in BRICS will not be tolerated by India, China nor Russia.

My bet is that Gold will rise by $100 or so on bad news and the retrace $40 for the next 12 months which gives a handy $720 rise from here to $USD 3500 or a 20% rise approximately. The Gold Bars hidden in your partner's knicker drawer will still weigh the same.

View attachment 187352

gg

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.