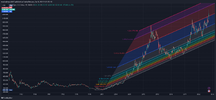

rcw1 got some decisions to make mate....Based on the macd, time to sell?

The ball is bouncing higher.... mostly anyways, the barrier has lifted. For mine, wait and see.. Nothing to lose, reckon, more to gain. Patience without procrastination weighs heavily on rcw1 mind... The thing is rcw1 got plenty of time. A gold believer from way back. At the end of the day and when the dust settles, with respect to your question:

Based on the macd, time to sell?

Not yet.

Have a great day bloke. Hope the North Coast is treating you just dandy.

Kind regards

rcw1