- Joined

- 20 July 2021

- Posts

- 11,862

- Reactions

- 16,533

Are there any older members who used to be chalkies can tell everyone when this reversal is going to end.

I only got up because the dogs were barking.

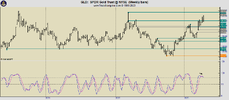

View attachment 155772

gg

your dog deserves a treat , can it text as well ( when you are busy at work , not watching the markets )

seems to be testing the $2000 level , so what is the news elsewhere that needs to distract the market ( for instance is there a bond auction on the go )