- Joined

- 20 July 2021

- Posts

- 11,862

- Reactions

- 16,533

yes retain some caution , desperate governments do despicable things ( even the US closed the gold window once )Not sure where to put it,

It is bigger than gold but gold is key..

I noticed that article and the info that our treasurer went to get orders from the US/deep state before releasing the budget

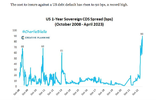

Which makes me think the US might plan it's fight back to keep its USD supremacy , currently in a bad way

Albanese even got a lolly with a listing in the 100 most influencing people in the world..he should open a tik tok account.

So the Aussie government is being prep to be part of something big

I expect brutal move on gold in the very near future, this is an economic/financial war raging around USD supremacy and Gold, US and servants (EU, Australia,Canada maybe Japan) vs the rest of the world

I do not know the form it will take: Gold seizure ,even more suppression via JPM ,new crypto currency and control but this is on

gold is the enemy of all fiat currencies ( it has no third-arty risk )