- Joined

- 13 February 2006

- Posts

- 5,267

- Reactions

- 12,127

From that free 'Gold summit presentation' yesterday picked up on following stated below (that apparently impacts Gold price since has a direct correlation)

"To calculate the REAL interest rate, you take the US Federal Reserve rate...and SUBTRACT inflation from it.

But NOT current inflation, which is obviously really high around the world right now.

You use inflation EXPECTATIONS — which is where the market says inflation is headed.

Basically, subtract inflation expectations from the Federal Reserve interest rate...and you get ‘real’ interest rates.

When real rates fall…Gold often soars (and real rates have begun to fall)".

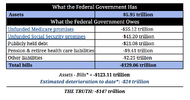

The other important thing mentioned was that the US economy can't withstand/survive prolonged elevated/high interest rates due to the US drowning in debt - so watch for real rates to ease/fall in the short to medium term imo which is bullish for Gold.

Mosler is one of the, if not primary MMT idiots. He seems to be spinning this as a positive, rather than driving inflation higher.

But essentially, the higher the real interest rate, the higher the deficit becomes. It is the classic debt doom loop.

The Treasury under Yellen is already in collusion with Central banks around the world in the 'daisy chain' operation. This is essentially CBs buying each others debt in a sub rosa QE. Inflation and LOTS of it is the only way that Western governments survive without re-monetising gold.

Using the 1980's CPI calculation:

Of course the masses, even if they realised, don't have the marginal buying power to protect themselves, hence violent protests or revolution in the worst case scenarios.

Then add in:

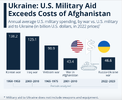

Mr Putin can outlast the US.

Given that this is and always has been yet another proxy war between the Soviets and US (starting in 2014 by Obama) the US is getting their lunch handed to them (again) due to the level of debt that they went to war with. Unsustainable.

jog on

duc