- Joined

- 8 March 2007

- Posts

- 2,954

- Reactions

- 4,098

bitcoin is like a cockroach it doesn't want to dieSnapshot this morning.... whatever happened to the thesis that Bitcoin was dead? At least locally Gold will lift higher with AUD down, but the relic isn't doing that well while the new kid resurges.

- AUD -0.3% to 68.82 US cents

- Bitcoin +2.2% to $US24,576

- Spot gold +0.5% to $US1844.31 /oz

Note the similarity to the AUD/USD chart.Looking at the chart of GLD, gold has reacted to the support zone at 169.5 which coincides with the 50% time&price Fib line (shown in blue). In spite of this bullish reaction I'm still bearish-to-neutral on gold. GLD has broken below the 50daySMA and my indicators are still bearish, this bullish looking daily bar happened on low volume and I'm putting it down to the fact that some traders may not want to hold positions over the long weekend in these uncertain times.

View attachment 153204

@eskys I'm bearish to neutral at the moment, the next day or two will hopefully clear things up a bit.

I'm neutral to a teensy bit bullish atm., in reply to your post from 4 days ago, which can be a long time in market action, so you may have changed by now.@eskys I'm bearish to neutral at the moment, the next day or two will hopefully clear things up a bit.

Yes I said on Jan25 that it had a good chance of going to 185. I acknowledge that 8-9 bars up is a watchout area but sometimes the trend keeps going and I thought it had a chance of doing that this time. I changed my view in my post on Jan29. My basic approach in trading is reading the market and when the markets became more volatile I changed my indicators that I use to give me a more sensitive read and I use these indicators to enter and exit trades. So if I enter a position and it's looking good like it will make it to the next resistance zone, then I'm thinking 'looking good', but if the next day my indicators show me that weakness is coming into the market then I get ready to exit. I look at the bigger picture as well because I like to know about the environment in which I'm trading. Basically when I said that I think it may go further it was with your alarm signal of '9 closes' in mind but my indicators reacted to the market making me change my view. I hope this explains why I made the calls that I did and why I changed my view after a few more bars.At 180 on GLD after 9 consecutive higher weekly closes you were convinced we had a good chance of going to 185! All it took was a fall to 170 to change your mind

@Garpal Gumnut my view is very short term, in the very big-picture I'm still bullish.I cannot see a big bear move at present

I'm looking forward to so called 'free trade recommendation' lol as last time made 20% profit in just 10mins! lol haha ? watching 'the herd' all buy in at once!

Thanks @DaveTradeWhy Gold Could Hit $30,000 Per Ounce

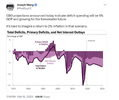

US stock trading is closed for President's Day, leaving investors to focus their attention elsewhere. The precious metals and crypto markets remain open as Bitcoin added to its recent gain, climbing another 2.5% this morning to reach $25,000. Gold, on the other hand, traded flat, adding to gold bug frustrations.

Bitcoin rose roughly 11% over the last week while gold fell 1.26%. Many crypto investors still believe that Bitcoin should be viewed as "digital gold" in that it's a good hedge against inflation.

Based on last week's hotter-than-expected inflation reports (CPI/PPI), it'd be easy to make that argument. Bitcoin soared while gold - the "true" inflation hedge - slumped. A massive retail sales beat also contributed to inflation fears.

But Bitcoin hasn't always had an inflation-positive relationship. Bitcoin fell 64% in 2022 despite galloping inflation in the first half of the year. Gold, meanwhile, finished the year flat.

Analysts have said in the past that Bitcoin's massive 2020/2021 run-up was fueled by the expectation that inflation would rise. That's partially true.

During that time, however, nearly every risk asset rallied. Stimulus programs sparked an "everything rally" that largely ignored inflation. Gold soared as did stocks and Bitcoin. Each asset class outpaced inflation by a wide margin.

If inflation starts accelerating again, stocks, crypto, and gold should rise. But precious metal investors say that stocks will only appreciate nominally as inflation outpaces stocks, resulting in negative inflation-adjusted (aka, "real") gains. Gold, meanwhile, will erupt higher once the market realizes that the Fed is unable to bring inflation lower.

That's the theory, at least. It sort of happened in 1979 when inflation was sky-high and economic fear reached a fever pitch.

Fed Chairman Paul Volcker then stepped in and uncorked a series of huge rate hikes that strangled inflation, bringing it (and gold) substantially lower.

That's why gold has been unable to outperform stocks long term; something always happens to either crush inflation (Volcker) or the economy improves enough to assuage economic fears.

But according to cycles expert Charles Nenner, inflation is going to soar no matter what the Fed does with rates, resulting in a rally that takes gold to $30,000 per ounce as stocks tank.

"You don’t hear the talk anymore that the Fed is going to lower rates because it is so ridiculous. If you are an insider, the fed funds rate in the futures just made a new high. So, now everybody is expecting a much higher fed funds rate than a few months ago. We are not out of trouble yet, and the bounce in stocks is almost over," Nenner said in an interview with USAWatchdog.com last week.

He also sees short-term rates rising until 2024 when the fed funds rate peaks at 6.5%. But rates alone won't shift sentiment lower, Nenner said. He correctly predicted last year that the war in Ukraine would only intensify, and a future escalation would crash stocks another 40% toward the latter half of this year.

“If the West does not understand what is going on and starts bringing in airplanes, I am really afraid for the worst. Nobody has any idea how other countries think. They think you can push everybody around, and you can’t push everybody around. At a certain moment, they will have enough. I don’t think we are ready for a big war, not even to mention a nuclear war. So, something is going to come and make everyone very afraid, and I think this is why the markets will go down," Nenner explained.

"Based on the war cycle, the war is going to pick up, and it is not going to end well.”

Nenner still thinks, however, there's "an enormous upside for gold" and that the rally should begin in only a few weeks.

"I say enormous because I have inside information from the big economic summit in Davos. I heard things that can make your stomach turn. They are really concerned with taking out cash. They will have digital currency. Gold can hit $2,500 [per ounce], and we said that years ago. If it goes to that, gold can go to $30,000 per ounce. That could be because maybe things get so bad they have to go back to the gold standard.”

Nenner's essentially repeating what gold bugs have been saying for years: the death of the dollar will result in a gold "mega cycle" that takes its price per ounce to nosebleed levels.

And, while skeptical investors will always applaud that kind of statement - especially from Nenner, who has been very accurate - it also falls under the umbrella of "this will eventually happen, but who knows when."

Yes, Nenner will probably be proven correct. But the phrase "nothing ever happens" rings true here. The subversion of the West has been an excruciatingly slow and boring affair. It could be a decade (or more) until the dollar truly dies. Meanwhile, Bitcoin could easily dwarf gold's gains in the short term. It happened before, and it will happen again.

So, while holding gold in your portfolio is a good idea, waiting on it to rally to $30,000 per ounce isn't. It will likely take a long time for gold to reach that price level. Meanwhile, spending your energy elswhere (like short-term trading assets that tend to move more than gold does) might be the wiser choice.

View attachment 153323

soonThanks @DaveTrade

My thinking exactly and why I sold my large holding in PMGOLD recently.

The way Gold is sashaying about atm. the AUD/USD follows and very little profit ( or loss ) can be made with its movement.

Other assets are moving as you say including cash/bonds with greater safety.

I have no doubt Gold will progress well past $USD2000.

The question is when.

gg

I think that is a fair comment although a teensie bit harsh.soonCrystal Ball methodologies

have a very nice night.

Kind regards

rcw1

Yeah me. I can't wait for his free tip at the end of an hour of listening, although last time the tip was HRZ.Anyone else here get free invite from Brian Chu (Gold Fund founder)

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.