gg, how does that translate into the price in gold shares?Gold $USD1812

$AUD2691

So the decrease in Gold price in $USD has made Gold approx $AUD10 higher in 2weeks as the AUD/USD falls.

Interesting times.

gg

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,782

- Reactions

- 10,542

To be honest I haven't been following Aussie Gold stocks since last year.gg, how does that translate into the price in gold shares?

Anyone else care to comment.

gg

Don't have any gold shares now, got out about a fortnight ago. For some reason, I now have a mental block and cannot think clearly.....hope forum members have more clarity.

I'm signing out. Need to take a drive and put bins out......have a good day, everyone.

I'm signing out. Need to take a drive and put bins out......have a good day, everyone.

- Joined

- 13 February 2006

- Posts

- 5,267

- Reactions

- 12,127

It must be noted that Your DXY chart above is horribly out of date

FOUR (4) weeks out of date

It seems Everything has changed a Month ago

This all about "The Now" and

Not October when the DXY was in a different Hemisphere

View attachment 153604

View attachment 153606

Salute and Stay Safe & Dry

View attachment 153605

Capt. Chazz,

I think you miss the point. It is not based upon a 'technical' outlook. It is based on a fundamental outlook by the powers that have the financial firepower to dictate to the market, particularly when they are working together to achieve the same end.

The chart was provided merely to highlight the confluence of dates. As such, it is in 'date'.

The proof of course will be in the pudding: will the current rally be: (a) continuation of bull trend or (b) trend change with a correction to mean rally.

We will find out in due course.

jog on

duc

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,782

- Reactions

- 10,542

Your $DXY chart has all the appearances of the beginning of an EW Wave 3 btw.

jog on

duc

Fortunately I am not privy to the conversation between you and for whom you posted it, so I may have missed the context.

gg

- Joined

- 8 March 2007

- Posts

- 2,957

- Reactions

- 4,102

CORRECT!So, if we agree that the dollar index will go up, that means it's not good for gold (that's how I understand it) We need the dollar to come down which will help commodities........is this correct, Captain, gg, Dave, anyone?

- Joined

- 25 July 2021

- Posts

- 875

- Reactions

- 2,215

@eskys yes that is the case regarding the us$ index but then you have overlay the au$-us$ exchange rate on top of that because we are dealing in Australian Dollars. It's a two step relationship. After you do it a few times you get use to how to think about it.So, if we agree that the dollar index will go up, that means it's not good for gold (that's how I understand it) We need the dollar to come down which will help commodities........is this correct, Captain, gg, Dave, anyone?

- Joined

- 8 March 2007

- Posts

- 2,957

- Reactions

- 4,102

Except ALL Commodity contracts are signed in The World's Reserve Currency USD ( The Big Buck) and That's the Conundrum@eskys yes that is the case regarding the us$ index but then you have overlay the au$-us$ exchange rate on top of that because we are dealing in Australian Dollars. It's a two step relationship. After you do it a few times you get use to how to think about it.

Stay Safe & Dry

- Joined

- 13 February 2006

- Posts

- 5,267

- Reactions

- 12,127

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,385

- Reactions

- 11,767

- Joined

- 13 February 2006

- Posts

- 5,267

- Reactions

- 12,127

- Joined

- 25 July 2021

- Posts

- 875

- Reactions

- 2,215

GLD's price has just turned up into a price zone coming from price highs in Nov 2011, Feb 2012 and Oct 2012.

This price zone has been both supportive and resistive to price on a number of occasions through 2020, 2021 and 2022, but price has also been able to push through this zone a number of times during this period of time.

Using a standard MACD indicator on the Daily chart to show momentum, it can be seen that the MACD line has just crossed the signal line as the price came up into this zone. My proprietary indicators are also showing me that short-term momentum is up with the $AUS-USD trending down at the moment which would be supportive of a bullish position. The question is, will this short-term momentum continue to grow in strength driving the market up through this zone. For me it's a question of the time zone that you are looking at, to trade this move up I would want to be in three bars ago because on the weekly or daily time frame it's still a counter trend move. It's just at that very awkward position on the daily chart right now where it has the potential to turn south at any moment.

This price zone has been both supportive and resistive to price on a number of occasions through 2020, 2021 and 2022, but price has also been able to push through this zone a number of times during this period of time.

Using a standard MACD indicator on the Daily chart to show momentum, it can be seen that the MACD line has just crossed the signal line as the price came up into this zone. My proprietary indicators are also showing me that short-term momentum is up with the $AUS-USD trending down at the moment which would be supportive of a bullish position. The question is, will this short-term momentum continue to grow in strength driving the market up through this zone. For me it's a question of the time zone that you are looking at, to trade this move up I would want to be in three bars ago because on the weekly or daily time frame it's still a counter trend move. It's just at that very awkward position on the daily chart right now where it has the potential to turn south at any moment.

- Joined

- 3 May 2019

- Posts

- 6,341

- Reactions

- 10,023

Not quite true, the yuan is creeping in, slowly, but for intents , yes, the USD is still the dominant.Except ALL Commodity contracts are signed in The World's Reserve Currency USD ( The Big Buck) and That's the Conundrum

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,385

- Reactions

- 11,767

Not quite true, the yuan is creeping in, slowly, but for intents , yes, the USD is still the dominant.

Have watched quite a few 'experts' talking about the shift away from USD as the reserve currency for everything. It's hard to see this transition happening overnight, but the BRICs seem pretty keen to follow this up, and obviously when a nation goes to war and the international community can turn off their access to Swift and freeze money in USD accounts then it's a worry for them. I think China will be much better prepared than Russia was before they invade Taiwan. Watch this space.

- Joined

- 28 May 2020

- Posts

- 6,706

- Reactions

- 12,876

Yeah, go to Africa, and the pacific Islands and you will find the cits demand USD in cash.Have watched quite a few 'experts' talking about the shift away from USD as the reserve currency for everything. It's hard to see this transition happening overnight, but the BRICs seem pretty keen to follow this up, and obviously when a nation goes to war and the international community can turn off their access to Swift and freeze money in USD accounts then it's a worry for them. I think China will be much better prepared than Russia was before they invade Taiwan. Watch this space.

Its universally acceptable, everyone knows its "value", and you can buy anything in USD.

Try bribing an African dictator in Yuan or Roubles.

Mick

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,385

- Reactions

- 11,767

Yeah, go to Africa, and the pacific Islands and you will find the cits demand USD in cash.

Its universally acceptable, everyone knows its "value", and you can buy anything in USD.

Try bribing an African dictator in Yuan or Roubles.

Mick

Recently in the Maldives and a cafe didn't even accept Maldivian money. Just USD and credit card. Huh?

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,782

- Reactions

- 10,542

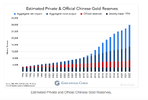

Yes, well, everyone has bought gold during mid last year to last month, The Russian cousins, The Chinese cousins, the Saudi cousins, The Indian cousins and me.GLD's price has just turned up into a price zone coming from price highs in Nov 2011, Feb 2012 and Oct 2012.

View attachment 153928

This price zone has been both supportive and resistive to price on a number of occasions through 2020, 2021 and 2022, but price has also been able to push through this zone a number of times during this period of time.

View attachment 153929

Using a standard MACD indicator on the Daily chart to show momentum, it can be seen that the MACD line has just crossed the signal line as the price came up into this zone. My proprietary indicators are also showing me that short-term momentum is up with the $AUS-USD trending down at the moment which would be supportive of a bullish position. The question is, will this short-term momentum continue to grow in strength driving the market up through this zone. For me it's a question of the time zone that you are looking at, to trade this move up I would want to be in three bars ago because on the weekly or daily time frame it's still a counter trend move. It's just at that very awkward position on the daily chart right now where it has the potential to turn south at any moment.

View attachment 153930

As far as I know I'm the only one to have sold mine.

I believe the buying is over and the price may drift south in $USD and the latter will strengthen.

That is not to say there will not be a quid made out of Gold in $AUD. But it won't be easy.

gg

Similar threads

- Replies

- 1

- Views

- 532

- Replies

- 171

- Views

- 10K

- Replies

- 7

- Views

- 2K