Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,774

- Reactions

- 10,531

Exactly my thinking duc, but I don't have the eloquence to put it as you have.Gold

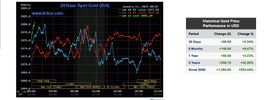

View attachment 151454View attachment 151453View attachment 151452View attachment 151451View attachment 151450

Wait, there's more!

Mr McLeod:

Macleod - This Is The Word Out Of Asia As Gold Price Approaches $1,900 - King World News

Today London analyst Alasdair Macleod spoke with King World News about what he is being told by his contacts in Asia as the price of gold approaches the $1,900 level.kingworldnews.com

The rise of gold into a hiking environment from the Fed. is/was the signal that a huge surge from gold is on the cards.

View attachment 151455

The ETFs are actually selling gold as the price rises. This is the exact opposite of how they 'should' operate. It is more easily seen with silver.

View attachment 151457View attachment 151456

It is also happening with gold.

Simply, the BBs responsible for suppressing the 'paper price' need to hold as much physical as possible to contain the leverage. With CBs buying so much, Russia and the Saudi's pushing oil for gold, the physical is fast disappearing and needs to be supplemented from the ETFs that hold physical. Hence, as the price rises, sales of physical from the ETFs will also rise.

jog on

duc

I'm actually looking to add.

gg