- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

I probably should have qualified my previous answer @eskysBut what is gold hinged on if not currency gg? I can't think the way you do. No other country or currency will take over USD. US and his buddies will rule for a long time to come

It is all a joke.

It really is.

Forget about the currencies is what I do, and just concentrate on Gold. ( In $USD until the Chinese, Russians , Japanese, Bantu or some other mob take over )

gg

you are probably better of buying a good metal detector , and go for a slow walk alone the beach or any other places with loose soil/sand ( regularly )It is all a joke.

It really is.

Forget about the currencies is what I do, and just concentrate on Gold. ( In $USD until the Chinese, Russians , Japanese, Bantu or some other mob take over )

gg

lets see how that translates to Aussie gold share prices ( remember those pesky rising costs )

I have found that 2-3 year resistance tops are irrelevant

No one, as far as I know leaves their Sell orders on for 2-3 years and becomes a resistance

They have either died and the Heirs do what Heirs do

Or they have simply Sold over the years

Salute and Gods' speed

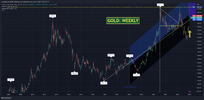

View attachment 151873

Thank you for your reply, gg, and an insightful one at that.I probably should have qualified my previous answer @eskys

I don't trade forex, I do change AUD in to USD and back again frequently as I have a cigar money stock only trading account with IG with which I trade both US and AU stocks. I've had it for 3-4 years and it is presently down about 2%. It has been as high as 25% positive. It's money I can afford to lose and great fun when I wake up in the middle of the night or see something on ASF that makes me go hmmmmmm.

So in a way I follow the AUD/USD and this is reflected in my Gold holdings in $AUD.

My pattern recently has been :

Buy Gold when Gold is down in $USD and sell when it marches past significant resistance in $USD, as in those $2000 bursts in recent times. ( I also sold some aussie Gold miners on those bursts, but only hold a US miner atm. )

My reasoning is that the difference in the forex is not as great as the gain in $AUD, nor is the fall in price of Gold in $AUD as great as in $USD when it falls.

Also in my real world ( not my cigar money world ) I use Gold as long term physical holdings (bar), and in my SMSF Stock Portfolio as an insurance policy against somebody like Cousin Putin starting a world war ( not that it is likely to happen ) and a crash occurring in the market.

Gold is not a get rich quick experience in my experience. It requires patience and an appetite for risk and loss in the short term.

I'm undecided what to do when Gold goes over $USD2000 next time, although my sentiment atm. is to hold as I believe it will go much further on the third attempt.

I agree that it will be a big mountain to climb to dislodge the $USD as the defacto reserve currency. I have in fact some notes in that currency stashed should Cousin Putin forget to take his medications some night.

gg

Gold chart analysis from 7:20 onwards..

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.