You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

Happy Friday!Good morning

The Dow nexus...

Have a very nice day, today.

Kind regards

rcw1

RMS now @ 0.895c +3.47%

BC8 now @ 0.335c +3.08%

Cheers tela

Good afternoon Telamelo,Happy Friday!

RMS now @ 0.895c +3.47%

BC8 now @ 0.335c +3.08%

Cheers tela

Nice work... Can smell the profit oozing out of your post ...

Hope you don't mind asking, you thinking of letting it run or cash in M8?

Kind regards

rcw1

Good afternoon rcw1Good afternoon Telamelo,

Nice work... Can smell the profit oozing out of your post ...

Hope you don't mind asking, you thinking of letting it run or cash in M8?

Kind regards

rcw1

Thanks for that lol Yeah trading/investing is enjoyable when it plays out exactly the way you want it too (if only it was this easy all the time hey !? lol haha)

I'll let it run using a very wide tailing stop loss (as nothing worse having a decent size position/being set & cashing in too soon - only to see share price sometimes continue on much much higher).

Good Luck with your trading!

Cheers tela

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,553

- Reactions

- 9,961

I was quite surprised to see Gold at $AUD2612 this morning, I was expecting a firmer $AUD to decrease the range bound Gold in $USD.

It would appear the Chinese cousins minor disagreement with the Chinese Emperor, over whether they have the right or not to flee a burning building, may be the cause of the fall in the $AUD.

Let us hope either the cousins or the Emperor can come to an agreement on what is the best action. The I-Back-Dan Pty Ltd. working out of the Caravan Committee at the hotel is willing to assist punters ( for a fee ) on the future direction of lockdowns in China.

gg

It would appear the Chinese cousins minor disagreement with the Chinese Emperor, over whether they have the right or not to flee a burning building, may be the cause of the fall in the $AUD.

Let us hope either the cousins or the Emperor can come to an agreement on what is the best action. The I-Back-Dan Pty Ltd. working out of the Caravan Committee at the hotel is willing to assist punters ( for a fee ) on the future direction of lockdowns in China.

gg

- Joined

- 20 December 2021

- Posts

- 218

- Reactions

- 500

Seems like commodities are being buoyed by the rebound in sentiment in China. Health officials in the country are due to give a briefing soon, and markets appear to be expecting a potential shift away from their current COVID-zero stance. Although that also opens the door to the possibility of the statement disappointing.

All trading carries risk, but it will be interesting to watch as it looks likely to spark further volatility despite outcome.

All trading carries risk, but it will be interesting to watch as it looks likely to spark further volatility despite outcome.

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Interesting take GG, I'm pretty much the opposite (in general). I often dread the Asian buying because it nearly always gets faded by the other sessions.

At least as far as I can tell, despite all the conspiracy theories and LBMA OTC still being the most liquid market, NY session and therefore COMEX futures still sets the marginal daily price.

Thought I'd post last nights 3 min chart as it highlights this phenomenon quite well.

The vertical shaded areas are the starting hour of Tokyo, London and New York FX sessions respectively.

As you can see, despite the allegedly "paper gold busting pure physical Shanghai gold exchange" in Asian hours and now the allegedly "paper gold busting pure physical Russian gold exchange" in European hours, not to mention the insanely huge paper LBMA OTC in European hours...it's COMEX that set the closing price for yesterday, nearly all offers were bid back to 2620.

Hopefully we get a bit of this now:

Usually you can see price increases that tend to stick are when, for whatever reason, Asia sells and offers some marginal cheapness to London/NY to bid.

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,553

- Reactions

- 9,961

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,179

- Reactions

- 11,360

Gold price rocketed up +$57 overnight to US$1,817 equates to AUD $2,646Houston....let's hope it's not all a big bear trap and China, interest rates and USD play the game.

$1800 psychological and horizontal resistance on my chart. $1836 on Wyckoff's Feb gold chart.

View attachment 149969

View attachment 149974

View attachment 149972

- Joined

- 13 February 2006

- Posts

- 5,100

- Reactions

- 11,601

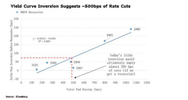

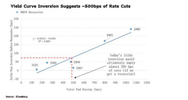

Gold & Silver are up because the markets believe that the Fed must pivot.

The yield curve indicates a 500bps cut due to the severity of:

(i) US deficits;

(ii) contracting GDP;

(iii) de-globalisation;

(iv) Russian/Chinese block de-dollarising;

(v) Energy shortages;

(vi) Rising unemployment;

(vii) Falling tax revenues

All requiring the Fed to increasingly monetise Treasury issued debt, or accelerating inflation which will reach double digits pretty fast in the US and potentially threaten the viability of USD.

jog on

duc

The yield curve indicates a 500bps cut due to the severity of:

(i) US deficits;

(ii) contracting GDP;

(iii) de-globalisation;

(iv) Russian/Chinese block de-dollarising;

(v) Energy shortages;

(vi) Rising unemployment;

(vii) Falling tax revenues

All requiring the Fed to increasingly monetise Treasury issued debt, or accelerating inflation which will reach double digits pretty fast in the US and potentially threaten the viability of USD.

jog on

duc

- Joined

- 25 July 2021

- Posts

- 869

- Reactions

- 2,202

I got back into Gold last night at the open, above the price where I previously got out, I made the decision to trade each leg up. The gap was unfortunate for my entry point but it didn't surprise me, there are gaps all through this chart. Gaping into resistance can be a reversal point but obviously I think this is the beginning of the next leg up. We shall all see what unfolds, if I keep my risk down in the trade then I'll still be ok if it doesn't work out.

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,553

- Reactions

- 9,961

I must admit to being more patient about Gold than the average punter.

The 5 yr chart would indicate that gold needs to hold a base at $USD 1800 and perhaps oscillate between that and $USD 1900 for a while to have any chance of decisively cracking $USD 2000 and forming a new base there.

Interesting times.

gg

The 5 yr chart would indicate that gold needs to hold a base at $USD 1800 and perhaps oscillate between that and $USD 1900 for a while to have any chance of decisively cracking $USD 2000 and forming a new base there.

Interesting times.

gg

- Joined

- 25 July 2021

- Posts

- 869

- Reactions

- 2,202

@Garpal Gumnut I think that the next couple of week's price action will show how strong or weak the Gold market is at the moment. The weekly chart is still looking good to me, it's possible that we are just starting a new uptrend.I must admit to being more patient about Gold than the average punter.

The 5 yr chart would indicate that gold needs to hold a base at $USD 1800 and perhaps oscillate between that and $USD 1900 for a while to have any chance of decisively cracking $USD 2000 and forming a new base there.

Interesting times.

View attachment 150027

gg

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,179

- Reactions

- 11,360

- Joined

- 13 February 2006

- Posts

- 5,100

- Reactions

- 11,601

Similar threads

- Replies

- 171

- Views

- 9K

- Replies

- 7

- Views

- 2K

- Replies

- 24

- Views

- 5K