You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price - Where is it heading?

- Thread starter guycharles

- Start date

-

- Tags

- gold gold price

- Joined

- 8 June 2008

- Posts

- 13,228

- Reactions

- 19,518

Mostly due to /compounded by a huge fall of AUD vs USD

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,770

- Reactions

- 10,528

I'll change my mind on "Where Gold is Heading" in light of the destruction of value in Crypto.Where is Gold going to next?. A refrain from all posters.

I have absolutely no idea to be honest what with the $USD, Ukraine, Fed, Russian Oil, China, Taiwan, US House and Senate elections, MAGA, The Democrats, De Santis, Old Boy Biden ( the Democrats really don't deserve to win a toad race at the old Airlie Beach hotel for picking him), Trump, Putin and all the other F-wits leading major nations in very troubled times.

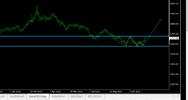

The 3 month chart looks hopeful for a breakthrough $USD1735 which will put $USD1800 within reach and then all the experts will be looking for $USD100 jumps through $USD2000.

I doubt if it will collapse down to or below $USD1600.

So, my guess is UP or RANGE.

View attachment 148983

gg

$USD1735 is easily obtainable and once through that over $USD1800 is not out of the question.

As to $USD2000+ , I would not bet against it.

gg

- Joined

- 12 January 2008

- Posts

- 7,363

- Reactions

- 18,406

Agreed, money should flow from crypto back to gold. That is, if they can get their money out of the "exchanges".

- Joined

- 20 July 2021

- Posts

- 11,851

- Reactions

- 16,520

yes that will be interesting to watch ( and learn from )Agreed, money should flow from crypto back to gold. That is, if they can get their money out of the "exchanges".

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,770

- Reactions

- 10,528

Then there is so much "money" out there after the easing outside of markets, bonds, crypto, RE and Gold that Gold may be the only "safe" haven after interest rates peak early next year.Agreed, money should flow from crypto back to gold. That is, if they can get their money out of the "exchanges".

And it is a may.

I'm unsure how big the BTC market is now valued in comparison to other assets.

gg

- Joined

- 24 July 2021

- Posts

- 144

- Reactions

- 421

Looks like the current trend for Gold is the real deal, up 2.5% in overnight trade. USD starting to fall, Bonds falling as well. Gold miners should rocket higher today ?

I hope this is the case though who knows with my interests (NVA). The current board's strategic priorities having me lacking confidence they can capitalise on this movement.Looks like the current trend for Gold is the real deal, up 2.5% in overnight trade. USD starting to fall, Bonds falling as well. Gold miners should rocket higher today ?

- Joined

- 25 July 2021

- Posts

- 875

- Reactions

- 2,215

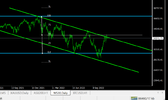

To follow up on my previous post on GLD, at this point I'm still bullish. As shown on the chart below I indicated that an aggressive trader could enter on Monday Nov 7th. I think that this move will probably go on to the resistance zone overhead between the 165-168 levels.

A new uptrend has not formed yet so it makes sense to continue to trade this in a tactical manner, so I'll be looking for a place to exit and then wait for a pullback to re-enter long if the market holds true to a long bias.

A new uptrend has not formed yet so it makes sense to continue to trade this in a tactical manner, so I'll be looking for a place to exit and then wait for a pullback to re-enter long if the market holds true to a long bias.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,365

- Reactions

- 11,728

To follow up on my previous post on GLD, at this point I'm still bullish. As shown on the chart below I indicated that an aggressive trader could enter on Monday Nov 7th. I think that this move will probably go on to the resistance zone overhead between the 165-168 levels.

A new uptrend has not formed yet so it makes sense to continue to trade this in a tactical manner, so I'll be looking for a place to exit and then wait for a pullback to re-enter long if the market holds true to a long bias.

View attachment 149069

That chart looks pretty good to me for a bottom at 151. The resistance at 167 ish Aug high and May/June lows and 200dma might be trouble.

There are those who will say its an obvious "W" reversal pattern on daily chart ..

View attachment 149039

Will it follow the US30 ? which is at 50% of its range atm

Just bored that all

Well then that's doing okay

Not a bad earn if you were on it ...

Have a very nice weekend.

kind regards

rcw1

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

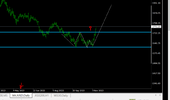

I take little pleasure in this view having being shown as correct

View attachment 148572

Supply above 2560 just continues to be ridiculously strong.

Nothing between 2560 - 2510 would really surprise me at all.

2680 would surprise me.

Well, colour me surprised, but the reaction to 2680 was not a nice one, so maybe a bit less surprised.

We spent less than one minute above 2680, in the very illiquid moments of the CPI print and supplied non-stop since then.

I am still skeptical.

- Joined

- 24 July 2021

- Posts

- 144

- Reactions

- 421

I think if you wait until you get ultimate proof that Gold prices are heading north that it slaps you in the face, you will miss out on profits.Well, colour me surprised, but the reaction to 2680 was not a nice one, so maybe a bit less surprised.

View attachment 149130

We spent less than one minute above 2680, in the very illiquid moments of the CPI print and supplied non-stop since then.

View attachment 149131

I am still skeptical.

In the end it’s your money.

- Joined

- 25 July 2021

- Posts

- 875

- Reactions

- 2,215

Currently GLD is moving up, priced in $US, but the $US is moving down in value thus helping GLD move up. The $AUS-$US pair is moving up so this will work against your long position in a GLD trade. Does anyone have a chart of Gold in Australian dollars to show us.

- Joined

- 25 July 2021

- Posts

- 875

- Reactions

- 2,215

- Joined

- 19 October 2005

- Posts

- 4,686

- Reactions

- 6,962

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

I think if you wait until you get ultimate proof that Gold prices are heading north that it slaps you in the face, you will miss out on profits.

In the end it’s your money.

Wow, thanks for the advice, I have been long gold since 2007 and never sold a single ounce. My allocation is 25% of my total net worth.

It also just so happens that after watching the price of something for 15 years, you tend to form opinions.

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,770

- Reactions

- 10,528

Currently GLD is moving up, priced in $US, but the $US is moving down in value thus helping GLD move up. The $AUS-$US pair is moving up so this will work against your long position in a GLD trade. Does anyone have a chart of Gold in Australian dollars to show us.

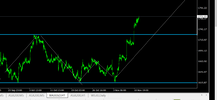

I'd agree @DaveTrade20 year gold chart - the reason I've lost interest day to day or month to month. Drives you mad. Conviction and mind numbing patience required. Different for traders. Chart is very bullish but break through does not look imminent to me.

Held

View attachment 149149

One's Gold horizon is best seen on a 6mo. to 3 yr. basis, at least mine is.

This equilibrates for the move in Gold and the move in the Aussie $AUD.

Any smaller horizon can cause indigestion as Gold moves up with a lower $USD and conversely moves down with a stronger $AUD for Australian holders in $AUD.

I like to keep Gold simple.

Will it be under $USD 1600 in 6mo. to 3 yrs ... Unlikely

Will it be more than $AUD 3500 in 6mo. to 3 yrs ... Likely

gg

Similar threads

- Replies

- 1

- Views

- 524

- Replies

- 171

- Views

- 10K

- Replies

- 7

- Views

- 2K